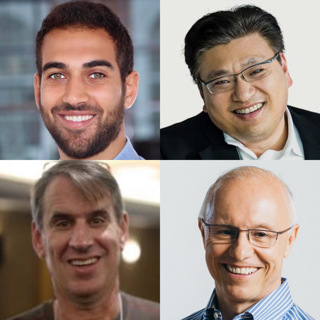

20VC: Shopify President, Harley Finkelstein on What is Being a Good Husband, What is Being a Good Father & How to Embrace Vulnerability and Authenticity in Leadership and Marriage

Harley Finkelstein is the President of Shopify, the platform modern commerce is built on. Over the last 12 years, Harley has partnered with Tobi to the tune of building Shopify's revenue to over $4.6BN in 2021 and the team to over 10,000 employees. On the side, Harley is an Advisor to Felicis Ventures and in the past has held board seats at CBC, Omers Ventures and The C100. If that was not enough, you can see Harley on a screen near you as one of the "Dragons" on CBC's Next Gen Den. In Today's Episode with Harley Finkelstein You Will Learn: 1.) The Founding Story: What was Harley's first entrepreneurial endeavour? How did seeing his family lose everything impact Harley's mindset and ambition? How did Harley first meet Tobi @ Shopify? How did the Shopify journey begin? 2.) Leadership Lessons: How has Harley changed as a leader over the 13 years with Shopify? How does Harley embrace vulnerability and authenticity in his communication with the team? What is Harley most insecure about when he looks at leadership today? What have been some of the biggest lessons Harley has learned from his board on what great leadership is? 3.) The Art of Marriage: What does Harley believe makes the most successful marriage? Why have Harley and his wife been seeing a marriage therapist from the early days? What is the biggest mistake people make when communicating with partners? How has Harley changed as a husband over the years? 4.) The Joy of Fatherhood: Does Harley always believe he has been a good father? What was his realisation moment that he was not being the father he wanted to be? What core elements of his behaviour did he change? How did that impact his relationship with his kids? How does Harley ensure he performs at the highest level while also being there and being present for his family? Item's Mentioned In Today's Episode with Harley Finkelstein Harley's Favourite Book: The Book of Ichigo Ichie: The Art of Making the Most of Every Moment, the Japanese Way

7 Mar 202249min

20VC: 3 Biggest Mistakes Founders Make When Scaling, Management 101 on Trust Building, Morale Maintenance and Hiring & What We Can Learn About Parenting From Nature Programs with Scott Dietzen

Scott Dietzen is Vice Chairman of the Board of Pure Storage and served as the Company's CEO from 2010 to 2017. Under his leadership, Pure grew to thousands of employees and completed an IPO in 2015. Dietzen is a four-time successful entrepreneur with WebLogic, Zimbra, and Transarc. Before Pure, he was President and CTO of Zimbra (now part of VMware), but originally acquired by Yahoo!, where Dietzen served as interim SVP of Communications and Communities. Prior to Zimbra, Dietzen was CTO of BEA Systems, where he helped craft the technology and business strategy for WebLogic that drove BEA from $61m in annual revenues prior to the WebLogic acquisition to over $1B. In Today's Episode with Scott Dietzen You Will Learn: 1.) The Journey to Pure Storage CEO: How did Scott make his way into the world of tech and startups? What was the hardest element of making the transition from CTO to CEO? What advice would Scott give to more technical leaders looking to make the move to CEO? Where do so many make mistakes? 2.) How To Build Trust in a Team: What are the most important ways that leaders can build trust with their teams? How can leaders be honest and share the hard truths without damaging role? What is the right tone to communicate both the big wins and big losses? Why does Scott always believe the losses teach more? How does Scott approach post-mortems? 3.) The Biggest Mistakes Founders Make: What are the single biggest hiring mistakes that founders make? What are the single biggest firing mistakes executives make? Why should founders sometimes say no to customers? How should founders approach investor selection and valuation for rounds? 4.) How to Optimise a Board: What specifically can founders do to optimise their board? What are the biggest errors founders make when communicating with their board? What is the value per word framework? How does it tell which board member is the best? Item's Mentioned In Today's Episode with Scott Dietzen Scott's Favourite Book: The 22 Immutable Laws Of Marketing

28 Feb 202237min

20VC Exclusive: Sahil Bloom on Raising his Debut Venture Fund (SRB Ventures), Why Traditional Venture Firms Are Going to Lose and How Sahil Built a Twitter Audience to 500K+ in 18 Months

Sahil Bloom is the Founding Partner @ SRB Ventures, a $10M fund that leverages the 500K followers Sahil has amassed to invest at the intersection of venture and media. Previously, Sahil spent 7 years at a large investment fund managing >$3.5 billion in capital and serves on the board of 4 companies. He has also been an active angel investor in over 30 companies. In Today's Episode with Sahil Bloom You Will Learn: 1.) How Sahil made his way from a career in traditional finance to building a media company and leveraging that to raise the latest SRB fund? How does Sahil advise others is the best way to "find their zone of genius"? 2.) How To Build a Media Engine: What have been some of Sahil's biggest lessons on what works on Twiter and what does not work? What is the golden rule for Twitter? How does Sahil plan and come up with ideas for his Twitter threads? What tools and software does he use? How long does each thread take? 3.) The End of the Road for Traditional Venture: Why does Sahil think traditional venture is dying? What newcomers will take the place of the existing incumbents? Why does he think they are weak? What do new players provide that they do not? Which existing players will remain and be strong? Which will fade out? Does Sahil believe that VCs really provide any value? 4.) SRB Ventures: Why did Sahil decide to raise the new fund? How did he decide on size of the fund? What is the strategy? What is the portfolio construction? How does SRB provide media services others do not? How did Sahil meet Tim Cook and get him to invest in the fund? What is the biggest thing Sahil believes most people misunderstand about luck? Item's Mentioned In Today's Episode with Sahil Bloom Sahil's Favourite Book: When Breath Becomes Air: Kalanithi Paul Sahil's Most Recent Investment: Wander

25 Feb 202241min

The Tiger Global Memo: From Sequoia Capital to Benchmark and Thrive: The World's Best on the Rise of Tiger Global

Tiger Global are one of the most discussed venture firms on the planet. With a deal cadence and capital deployment speed that is unmatched, they have made their mark on the venture landscape like no other over the last 24 months. Today we are joined by leaders from Sequoia, Benchmark, Thrive Capital, General Atlantic, GGV and Aleph to discuss the rise of Tiger and how it impacts the venture ecosystem. In Today's Episode on Tiger Global You Will Learn: 1.) Doug Leone: Sequoia Capital Why we need to change the words when use in venture? Why we need to get rid of "the game"? How does the rise of Tiger compare to the rise of prior entrants with the same approach? Why does Doug believe that the craft of venture will persist despite these new entrants? 2.) Bill Gurley: Benchmark Capital How does Bill analyse the change in late stage venture today? What are the main drivers of the increased competition in late stage venture? Why does Bill get concerned not by Tiger but how others respond to Tiger's model? How does Bill analyse the entry of hedge funds and PE funds into traditional venture models? 3.) Michael Eisenberg: Aleph How does Michael think about the "weaponisation of capital"? What are the significant benefits for a fund of having more capital than their competitors? How does this capital advantage change in boom and bust times? 4.) Anton Levy: General Atlantic Why does Anton believe that funds are leveraging their assets more efficiently than ever? How does Anton approach the mindset of AUM scaling without lowering returns? Why does Anton never want to compete on price? How does GA think about competing in a world of Tiger and hedge funds investing in tech? 5.) Hans Tung: GGV Why did Hans always believe the model to look at moving forward was Tiger? Why does Tiger's business model allow them structural and financial advantages over their competitors? What does Hans make of the data network effects of Tiger with their strategy? 6.) Kareem Zaki: Thrive Capital Why does Kareem think Tiger's approach makes absolute sense? Why does Kareem believe so many in venture like to try and discredit the Tiger model? How does Tiger's approach differ to Thrive's?

23 Feb 202220min

20VC: Faire's Max Rhodes on Three Steps To Hire the Best Candidates, Why Every Company Should Have a Strategy Doc and How To Do It & The Art of Referencing; How to Get the Most Out of Every Reference

Max Rhodes is the Co-Founder and CEO @ Faire, the online marketplace where retailers discover their next bestsellers from independent brands across the globe. To date, Max has raised over $1.1BN with Faire from some of the best including Sequoia, Founders Fund, DST, Forerunner, Lightspeed and many more. Prior to starting Faire, Max spent close to 5 years at Square in numerous different roles including Director of Consumer Product at Caviar. In Today's Episode with Max Rhodes You Will Learn: 1.) The Founding Story: How Max made his way into the world of startups with his joining an early Square team? How did his 5 years at Square impact how he approaches company building with Faire? How did Square's approach to product and mission impact Max's thinking? 2.) How To Hire Effectively: How does Max construct the hiring process? Where do many founders make mistakes? What does Max mean by "deep behavioural interview"? What questions does he ask? What are the signals of 10/10 candidates? What are red flags he looks for? How does Max determine capability? What literal tests can be done to test for this? 3.) How To Reference People: How does Max approach the referencing process when hiring people? How does Max make the other side feel comfortable, so they will open up and share everything? What have been some of Max's biggest lessons on what it takes to do referencing well? Where do many make mistakes with referencing? How does Max use an "out of 10" system to determine the quality of the candidate? 4.) How to Strategise: How does Max use strategy docs to orient the direction of the company? How often does Max write them? How long do they take to write? What are the core components of the strategy docs? Who else is involved in their writing? Once written, what is the right format to discuss with the team? How does Max approach how rigid he is to the strategies outlined? How does he determine whether he should change strategy or stick to plan? Item's Mentioned In Today's Episode with Max Rhodes Max's Favourite Book: Good Strategy Bad Strategy, Who: The A Method for Hiring

18 Feb 202240min

20Growth: Five Key Functions of a Growth Team, The Biggest Lessons Starting Uber's Growth Team and Scaling Facebook's, How To Structure The Hiring Process for Growth and What Separates Good From Great in Growth Leaders with Ed Baker, Former VP of Growth @

Ed Baker is an angel investor and growth advisor to various startups including Lime, Zwift, Whoop, Crimson Education, GoPeer, and Playbook. Ed was the VP of Product and Growth at Uber from 2013-2017. Prior to Uber, Ed was the Head of International Growth at Facebook, a company he joined after they acquired a startup he co-founded called Friend.ly, which had grown to over 25 million users. In Today's Episode with Ed Baker You Will Learn: 1.) Ed Baker: Entry into Growth: How Ed made his way into the world of growth from his start founding a dating site while at Harvard? How he made his way to lead international growth at Facebook? How his time with Facebook led to his joing Uber to start Uber's growth team? What were Ed's biggest lessons from Uber and Facebook? How did his approach to growth and mindset change as a result of his time there? 2.) When is the Right Time: When is the right time for startups to hire their first growth leads or reps? How should they determine whether to promote from within or hire externally? What are the biggest mistakes startups make on the timing of this hire? How can startups accurately assess whether they have product-market-fit? 3.) Who To Hire: Step by step, how does Ed structure the interview process for all new growth hires? What are the must ask questions for growth leaders to ask candidates in interviews? What are the clear signs and answers that suggest a 10x growth hire? What literal tests does Ed do to determine the quality of a hire? How do the best perform? 4.) Onboarding and Integration: What is the optimal onboarding process for all new growth hires? How do the best growth hires start in the first 60 days? What do they achieve? What are some of the early signs that a growth hire is not working out? How should the relationship be between the CEO and the Head of Growth? How can the Head of Growth foster a strong relationship between growth and product teams?

16 Feb 202250min

20VC: Bedrock's Geoff Lewis on Whether VCs Actually Provide Value or Not, Why Bedrock Does Not Have An Ownership Focus and The Difference Between Principles and Rules When Building a Firm or Company

Geoff Lewis is the Founder and Managing Partner @ Bedrock, now with over $1BN in AUM, Bedrock invests in breakout technology companies that are incongruent with popular narratives. In the past, Geoff has backed some generational defining companies such as Wish, Lyft, Nubank, RigUp, Vercel, Anduril and many more. Prior to founding Bedrock, Geoff was a Partner @ Founders Fund. In Today's Episode with Geoff Lewis You Will Learn: 1.) How Geoff made his way into the world of venture with his joining Founders Fund? How his time with Founders Fund led to his co-founding Bedrock with Eric? 2.) Geoff Lewis: The Investor: How does Geoff reflect on his own relationship to price? How does he determine when to pay up vs walk away? How does Geoff approach the re-investment decision-making process? Where do most go wrong when it comes to allocating reserves? What have been some of Geoff's biggest misses? How did they impact his investing mindset? Why does Geoff not believe that ownership is as crucial as other VCs suggest? 3.) Bedrock: The Firm What have been some of the biggest challenges in building Bedrock? Where does Geoff believe many firms make core mistakes in firm building? What are the differences between principles and rules? Why does Geoff believe all firms need to have principles? How does Geoff approach internal talent building? What are the signals of people that will succeed in venture? How do they approach learning? 4.) The Market: How does Geoff analyse the current state of the venture market? Does Geoff agree with the notion of "play the game on the field"? Why does Geoff think markups are BS and just VCs looking for external validation? How has Geoff learned to isolate from the VC community and retain that purity of mindset working with great entrepreneurs? Item's Mentioned In Today's Episode with Geoff Lewis Geoff's Favourite Book: Friedrich Nietzsche Geoff's Most Recent Investment: Praxis

14 Feb 202234min

20VC: Box's Aaron Levie on Why Founders Cannot Hedge Their Bets, The 2 Categories of Wrong Decision and How To Avoid Them & The Biggest Dangers of Being Over-Funded as a Startup

Aaron Levie is the Founder and CEO @ Box, the company incorporating the best of secure content collaboration with an intuitive user experience suited to the way people work today. Prior to their IPO in 2015, Aaron raised from some of the best in the business including the main man Mark Cuban, a16z, Emergence, DST, Coatue, DFJ and many more. Aaron founded the company from his dorm room at the University of Southern California and has led the company to 1,900 employees and over $770M in revenue, as of 2021 data. In Today's Episode with Aaron Levie You Will Learn: 1.) How Aaron founded Box from his dorm room at the University of Southern California? What was that founding a-ha moment? What did the first year look like? Does Aaron agree, "serial entrepreneurship is overrated"? 2.) Phases of Leadership and Company Growth: How does Aaron define the different phases of leadership required as a company grows? Which phase did Aaron find the most challenging? How did he overcome it? What are the first things to break when companies grow? What can founders do to prevent this? Does Aaron agree, "the best CEOs are the best resource allocators"? 3.) The Market: How does Aaron thinkj about the dislocation between private company valuations and public company market caps? What does Aaron believe are the biggest challenges founders face when they are over-capitalised? What does Aaron mean when he says, "raise when cash is cheap, spend as if it was expensive"? How does Aaron advise founders on fundraising today? 4.) The Team and Culture: How does Aaron create a safe space where all team members can come to him with anything? How does Aaron approach effective goal setting? How does one balance between achieveable and also aggressive goals? How does Aaron approach the art of delegation? What is his decision-making framework for what to delegate vs what to control? Item's Mentioned In Today's Episode with Aaron Levie Aaron's Favourite Book: Innovator's Dilemma: When New Technologies Cause Great Firms to Fail (Management of Innovation and Change)

11 Feb 202234min