Every Company Is a Fintech Company

"Why Every Company Will Be a Fintech Company -- The Next Era of Financial Services and the 'AWS Phase' for Fintech" by Angela Strange.You can also find and share this essay at a16z.com/fintecheverywhe...

7 Heinä 202015min

Read-Alouds, Continued

Today we're continuing a series we started a while ago of read-alouds (for more context on the why and why now check out episode #500 on how we podcast!).The first was episode #544 in April, It's Time...

7 Heinä 202051s

Journal Club: Revisiting Eroom's Law

Eroom’s Law is Moore’s Law spelled backwards. It’s a term that was coined in a Nature Reviews Drug Discovery article by researchers at Sanford Bernstein and describes the exponential decrease in bioph...

5 Heinä 20209min

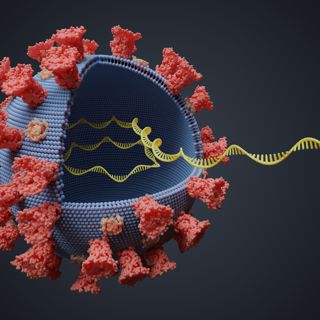

Preventing Pandemics with Genomic Epidemiology

The COVID-19 pandemic has increased the visibility of scientists and the scientific process to the broader public; suddenly, scientists working on virology and infectious disease dynamics have seen th...

30 Kesä 202034min

Journal Club: Therapeutic Video Game on Trial

In this episode of the a16z bio journal club, we cover one of the key clinical trials that supported the recent FDA approval of the first prescription video game. The game was developed by Akili Inter...

28 Kesä 202017min

Gross Margins, Early to Late: What They Do (and Don't) Tell You

Gross margins are essentially a company's revenue from products and services minus the costs to deliver those products and services to customers, and it's one of the most important financial metrics a...

27 Kesä 202036min

Building Products for Power Users

As more digital natives have entered the workplace, they have brought with them the expectation that their software should both be a joy to use and allow them to be power users. That is, users who con...

24 Kesä 202023min

Journal Club: Building a Better Chloroplast

In this episode of the a16z bio Journal Club, bio deal team partner Judy Savitskaya and Lauren Richardson discuss research that aims to enhance the efficiency of photosynthesis and carbon fixation. Th...

21 Kesä 202020min