300 · Patrick Petersson - We Should Not Die as Traders

In this episode we catch up with Patrick Petersson, who returns two years after his first interview on Chat With Traders on episode 260, where he shared his incredible story of overcoming hardship to ...

28 Touko 20251h 25min

299 · Michael Martin - Intersection of Emotional Intelligence and Tactics

Michael Martin, raised in a hardworking blue-collar community, embraced the same ethic. An entrepreneur at heart, he hustled from cutting grass when he was 12 to working all types of jobs including go...

14 Touko 20251h 33min

298 · Christian Mayer - The Power in Fixed-Sized, Non-Compounding Plays

Christian Mayer, with an institutional trading background, transitioned from equities to forex, focusing on fixed sized mean-reversion strategies with fundamental correlations where structural edge is...

29 Huhti 20251h 5min

297 · Cody Yeh - Slow, Medium, and Fast Money Strategies

A former engineer turned successful options trader, real estate investor and entrepreneur, Cody Yeh shares his incredible journey from the 9-to-5 grind to achieving financial freedom through smart inv...

10 Huhti 20251h 11min

296 · Dr. Brett Steenbarger - Playing to Your Strengths

Few people understand the minds of traders like Dr. Brett Steenbarger. As a psychologist who trades actively himself, he brings a rare combination of clinical expertise and practical experience to the...

18 Maalis 20251h 6min

295 · Steve Ruffley - Animal Speed, Size, and Being Right at the Right Time

Steve Ruffley transitioned from a highly competitive trading floor environment to trading professionally as a retail trader. His entrance into trading was unplanned - a mix of ambition, timing, and th...

18 Helmi 20251h 11min

294 · Ross Haber - Stock Leaders and Timeless Strategies Still Effective Today

Ross Haber’s trading philosophy is built on growth-focused strategies, heavily influenced by William O'Neil. Combining both technical and fundamental analysis, Ross emphasizes the importance of identi...

28 Tammi 20251h 16min

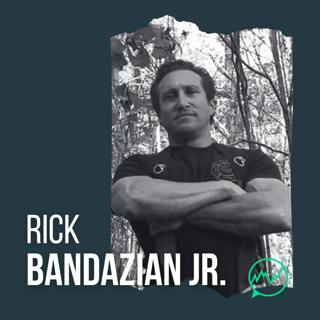

293 · Rick Bandazian Jr. - The Art of the Wait: Merger-Arbitrage Killer Moves

Rick Bandazian Jr., a seasoned trader with over 15 years of experience in event-driven and merger-arbitrage strategies, reflects on transitioning from an analyst at JP Morgan and First New York Securi...

19 Joulu 20241h 6min