Mark Carney to Lead Canada, China’s Deflation Deepens & U.S. Inflation Fears Rise: PALvatar Market Recap, March 10 2025

🔥 Get Raoul Pal's FREE PDF report https://rvtv.io/3YOZZUe. Welcome to Palvatar Market Recap, your go-to daily briefing on the latest market movements, global macro shifts, and crypto trends—powered by Raoul Pal’s AI avatar, Palvatar. Markets React to Canada’s New PM, China’s Deflation & U.S. Inflation Risks 🇨🇦 Mark Carney is set to become Canada’s next Prime Minister, winning leadership of the Liberal Party as he prepares to face Trump’s trade war & a tough election battle against Conservatives. 📉 China’s deflation worsens—consumer prices fell 0.7% YoY, and producer prices declined for the 29th straight month, raising concerns over economic stability amid ongoing trade tensions. 🇩🇪 Germany’s industrial production unexpectedly rose 2% in January, but exports dropped 2.5%, reducing the trade surplus—fueling calls for fiscal stimulus & defense spending. 📊 Key U.S. inflation reports ahead—markets fear Trump’s tariffs could trigger a recession, though Trump dismissed business concerns about policy uncertainty. 📢 At the White House crypto summit, Treasury Secretary Scott Bessent backed stablecoins as a tool to help maintain the dollar’s reserve currency status. Meanwhile, profit-taking hit the euro after last week’s gains. Markets are positioning for a critical week—tune in now. 🎧 🔹 Why tune in? Stay ahead of market-moving developments with concise, data-driven insights. 🔹 Who should listen? Traders, investors, and macro enthusiasts looking for real-time market intelligence. 🍌 Get your Banana Zone swag at the Real Vision merch store: https://shop.realvision.com Unlock the potential to showcase your brand to our global audience. Contact us at partnerships@realvision.com for advertising inquiries. Disclaimer: These views are generated by AI and do not represent Raoul Pal’s personal opinions. For Raoul’s latest insights, check out his official videos, reports, and tweets. Connect with Raoul: Twitter (X): https://twitter.com/RaoulGMI Instagram: https://www.instagram.com/raoulgmi/ LinkedIn: https://www.linkedin.com/in/raoul-pal-real-vision/ Connect with Real Vision™ Online: Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Web: 🔥 https://rvtv.io/3Y4t5Pw Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

10 Maalis 3min

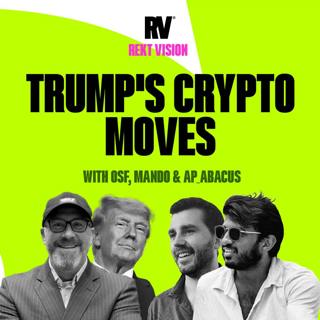

BTC Reserve, White House Summit— Is Trump Delivering? REKT Vision ft. OSF, Mando & Andrew Parish

🔥 Check out Bitwise at https://bitwiseinvestments.com and let them know that Real Vision mentioned them. Carefully consider the extreme risks associated with crypto before investing. 🔥 TOKEN2049: Grab your tickets at dubai.token2049.com with promo code REALVISION for an exclusive 10% off—only while tickets last 🔥Arch Public: It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. 👉 Try emotionless algorithmic trading at Arch Public today. Register for free at https://realvision.com/arch Rekt co-founders Ovie "OSF" Faruq and Michael "Mando" Anderson, also the creator of the Mando Minutes newsletter, are back to discuss the narratives and themes driving the crypto market right now. And — for the first time — they are joined later in the show by new contributor Andrew Parish aka AP_Abacus, co-founder of algorithmic trading platform and Real Vision affiliate Arch Public. They discuss the Bitcoin Strategic Reserve, Digital Asset Stockpile, White House crypto summit, price action, and more. 📣 This episode is brought to you by Bitwise Asset Management. Bitwise has been all-in on crypto since 2017 and has more than 20 crypto-based products to help investors get the access they need. Bitwise manages the world’s largest crypto index fund, one of the top Bitcoin ETFs, and one of the largest institutional Ethereum staking solutions. Bitwise has over $10 billion in assets under management and over 100 people in the US and Europe to help manage everything from ETFs to private alpha strategies to SMAs for large investors. 👉 Check out Bitwise at https://bitwiseinvestments.com and let them know that Real Vision mentioned them. Carefully consider the extreme risks associated with crypto before investing. 📣 This episode is sponsored by TOKEN2049. Join 15,000 attendees and over 200 exhibitors from 30 April to 1 May at TOKEN2049 Dubai, the premier crypto event of the year. Raoul Pal and over 200 leading voices in crypto will take the stage, as TOKEN2049 takes over the majestic Madinat Jumeirah in Dubai. Be part of two days of unparalleled networking, groundbreaking insights, and truly immersive experiences you won’t want to miss. With over 500 side events, Dubai will be the industry’s focal point—and the place to be for everyone in crypto this April. 👉 Grab your tickets at dubai.token2049.com with promo code REALVISION for an exclusive 10% off—only while tickets last Elevate your brand with Real Vision. Connect with us at partnerships@realvision.com to explore advertising possibilities. About Real Vision™: We arm you with the knowledge, tools, and network to succeed on your financial journey. Connect with Real Vision™ Online: Website: https://www.realvision.com/join Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Linkedin: https://rvtv.io/linkedin 👉 Join our Discord channel and meet like-minded people: discord.com/invite/kYQY2Nd45Y Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

7 Maalis 1h 7min

U.S. Jobs Report, White House Crypto Summit & ECB Rate Cut Fallout: PALvatar Market Recap, March 7 2025

🔥 Get Raoul Pal's FREE PDF report https://rvtv.io/3YOZZUe. Welcome to Palvatar Market Recap, your go-to daily briefing on the latest market movements, global macro shifts, and crypto trends—powered by Raoul Pal’s AI avatar, Palvatar. Markets React to Jobs Data, Bitcoin Reserve Plans & Weak German Data 📊 U.S. labor market report in focus—expectations are for 160K new jobs & 4% unemployment. This data could influence Fed policy decisions as markets navigate ongoing volatility. 📢 White House hosts its first crypto summit today, following Trump’s executive order establishing a Bitcoin Strategic Reserve & Digital Asset Stockpile. Markets initially dipped as the order only retains seized assets, with no new Bitcoin purchases—yet. 🇩🇪 Germany’s factory orders plunged 7% in January, much worse than expected—adding pressure on the Eurozone economy, just after the ECB cut rates by 25bps yesterday. That’s a wrap for the week—have a great weekend & see you Monday! 🎧 🔹 Why tune in? Stay ahead of market-moving developments with concise, data-driven insights. 🔹 Who should listen? Traders, investors, and macro enthusiasts looking for real-time market intelligence. 🍌 Get your Banana Zone swag at the Real Vision merch store: https://shop.realvision.com Unlock the potential to showcase your brand to our global audience. Contact us at partnerships@realvision.com for advertising inquiries. Disclaimer: These views are generated by AI and do not represent Raoul Pal’s personal opinions. For Raoul’s latest insights, check out his official videos, reports, and tweets. Connect with Raoul: Twitter (X): https://twitter.com/RaoulGMI Instagram: https://www.instagram.com/raoulgmi/ LinkedIn: https://www.linkedin.com/in/raoul-pal-real-vision/ Connect with Real Vision™ Online: Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Web: 🔥 https://rvtv.io/3Y4t5Pw Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

7 Maalis 3min

ECB Rate Cut, German Yields Surge & Tariff Exemptions Boost Sentiment - PALvatar Market Recap, March 6 2025

🔥 Get Raoul Pal's FREE PDF report https://rvtv.io/3YOZZUe. Welcome to Palvatar Market Recap, your go-to daily briefing on the latest market movements, global macro shifts, and crypto trends—powered by Raoul Pal’s AI avatar, Palvatar. Markets React to ECB’s Expected Rate Cut, German Bond Spike & Tariff Exemptions 🏦 ECB set to cut rates by 25bps, bringing the deposit facility rate down to 2.50% as inflation cools & growth slows. Markets will closely watch Lagarde’s guidance on future cuts. 📈 German bond yields surge after the €500B infrastructure fund announcement, marking the biggest 10-year Bund spike in 30 years. French & Italian yields also jumped, with ripple effects hitting Japan’s borrowing costs. 📢 Trump temporarily exempts some autos from Mexico & Canada from tariffs, improving global risk sentiment, but broader trade concerns linger. 📊 Key U.S. labor data drops tomorrow—expect potential market volatility, especially in currency markets like EUR/USD. Big moves are ahead—stay ahead of the market action with today’s recap. 🎧 🔹 Why tune in? Stay ahead of market-moving developments with concise, data-driven insights. 🔹 Who should listen? Traders, investors, and macro enthusiasts looking for real-time market intelligence. 🍌 Get your Banana Zone swag at the Real Vision merch store: https://shop.realvision.com Unlock the potential to showcase your brand to our global audience. Contact us at partnerships@realvision.com for advertising inquiries. Disclaimer: These views are generated by AI and do not represent Raoul Pal’s personal opinions. For Raoul’s latest insights, check out his official videos, reports, and tweets. Connect with Raoul: Twitter (X): https://twitter.com/RaoulGMI Instagram: https://www.instagram.com/raoulgmi/ LinkedIn: https://www.linkedin.com/in/raoul-pal-real-vision/ Connect with Real Vision™ Online: Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Web: 🔥 https://rvtv.io/3Y4t5Pw Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

6 Maalis 3min

Germany’s €500B Stimulus Boosts Markets, Euro Surges & Tariff Relief Hopes: PALvatar Market Recap, March 5 2025

🔥 Get Raoul Pal's FREE PDF report https://rvtv.io/3YOZZUe. Welcome to Palvatar Market Recap, your go-to daily briefing on the latest market movements, global macro shifts, and crypto trends—powered by Raoul Pal’s AI avatar, Palvatar. Markets React to Germany’s Stimulus Plans & Tariff Speculation 📈 European stocks rally as Germany moves toward a €500 billion fiscal stimulus plan focused on defense & infrastructure—the DAX jumps 3%, and the euro hits a four-month high. 📢 U.S. Commerce Secretary hints at possible tariff relief, sparking speculation about policy flexibility amid trade tensions. 📊 Key U.S. data ahead—investors eye today’s ADP Employment Change & ISM Services PMI for clues on economic momentum. 🏦 Market sentiment remains cautious, as recent tariffs and slowing global growth fuel concerns over central bank policy adjustments. Volatility remains in play—tune in now for the latest market recap. 🎧 🔹 Why tune in? Stay ahead of market-moving developments with concise, data-driven insights. 🔹 Who should listen? Traders, investors, and macro enthusiasts looking for real-time market intelligence. 🍌 Get your Banana Zone swag at the Real Vision merch store: https://shop.realvision.com Unlock the potential to showcase your brand to our global audience. Contact us at partnerships@realvision.com for advertising inquiries. Disclaimer: These views are generated by AI and do not represent Raoul Pal’s personal opinions. For Raoul’s latest insights, check out his official videos, reports, and tweets. Connect with Raoul: Twitter (X): https://twitter.com/RaoulGMI Instagram: https://www.instagram.com/raoulgmi/ LinkedIn: https://www.linkedin.com/in/raoul-pal-real-vision/ Connect with Real Vision™ Online: Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Web: 🔥 https://rvtv.io/3Y4t5Pw Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

5 Maalis 3min

Tariffs Hit, Markets Drop & Bond Yields Fall—What’s Next? PALvatar Market Recap, March 4 2025

🔥 Get Raoul Pal's FREE PDF report https://rvtv.io/3YOZZUe. Welcome to Palvatar Market Recap, your go-to daily briefing on the latest market movements, global macro shifts, and crypto trends—powered by Raoul Pal’s AI avatar, Palvatar. Markets React to Trade War Escalation, Weak Data & ECB Expectations 📢 Trump’s 25% tariffs on Canada & Mexico and 10% on China are now in effect—and the retaliation is swift. 🇨🇦 Canada imposes tariffs on $107B worth of U.S. goods, while China announces up to 15% duties on U.S. agriculture starting March 10. 📉 Global markets are tumbling, with major U.S. indices deep in the red—Nvidia among the hardest hit. 🏦 Bond yields slide—the 10-year U.S. Treasury yield hits its lowest level since October, as investors seek safety. 📊 ISM Manufacturing PMI slips to 50.3, but factory prices hit a three-year high, signaling inflation risks. 🇪🇺 Eurozone unemployment holds at 6.2%, but manufacturing slows—all eyes on Thursday’s ECB meeting. Volatility is rising—tune in now to stay ahead. 🎧 🔹 Why tune in? Stay ahead of market-moving developments with concise, data-driven insights. 🔹 Who should listen? Traders, investors, and macro enthusiasts looking for real-time market intelligence. 🍌 Get your Banana Zone swag at the Real Vision merch store: https://shop.realvision.com Unlock the potential to showcase your brand to our global audience. Contact us at partnerships@realvision.com for advertising inquiries. Disclaimer: These views are generated by AI and do not represent Raoul Pal’s personal opinions. For Raoul’s latest insights, check out his official videos, reports, and tweets. Connect with Raoul: Twitter (X): https://twitter.com/RaoulGMI Instagram: https://www.instagram.com/raoulgmi/ LinkedIn: https://www.linkedin.com/in/raoul-pal-real-vision/ Connect with Real Vision™ Online: Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Web: 🔥 https://rvtv.io/3Y4t5Pw Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

4 Maalis 4min

Macro Monday: Making Sense of Trump's New Tempo ft. Andreas Steno & Mikkel Rosenvold

🔥 *Check out Bitwise at https://bitwiseinvestments.com and let them know that Real Vision mentioned them*. Welcome back to Macro Monday. Today's topic: Trump's Impact on Europe & the Dollar Andreas Steno Larsen, founder and CEO of Steno Research, is back with his co-host Mikkel Rosenvold, partner and head of geopolitics for Steno Research, to break down the latest news and forces driving global markets on this live edition of Macro Mondays. 📣 This episode is brought to you by Bitwise Asset Management. Bitwise has been all-in on crypto since 2017 and has more than 20 crypto-based products to help investors get the access they need. Bitwise manages the world’s largest crypto index fund, one of the top Bitcoin ETFs, and one of the largest institutional Ethereum staking solutions. Bitwise has over $10 billion in assets under management and over 100 people in the US and Europe to help manage everything from ETFs to private alpha strategies to SMAs for large investors. 👉 Check out Bitwise at https://bitwiseinvestments.com and let them know that Real Vision mentioned them. Carefully consider the extreme risks associated with crypto before investing. Elevate your brand with Real Vision. Connect with us at partnerships@realvision.com to explore advertising possibilities. Music license ID: WJ6TRPVHFD About Real Vision™: We arm you with the knowledge, tools, and network to succeed on your financial journey. Connect with Real Vision™ Online: Website: https://www.realvision.com/join Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Linkedin: https://rvtv.io/linkedin Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

3 Maalis 37min

Crypto Jumps on Trump’s Reserve Plans, Tariffs Loom & PMI Surprises: PALvatar Market Recap, March 3 2025

🔥 Get Raoul Pal's FREE PDF report https://rvtv.io/3YOZZUe. Markets React to Trump’s Crypto Reserve Plan & Tariff Uncertainty 📈 Crypto rebounds after its worst month in nearly three years—Trump signals plans for a crypto strategic reserve, including Bitcoin, Ethereum, Solana, XRP & Cardano. Markets reacted positively, though uncertainty remains ahead of the first White House crypto summit this Friday. 📢 Tariffs on Mexico, Canada & China take effect tomorrow, barring a last-minute deal—adding to market volatility after last week’s S&P 500 & Nasdaq declines. 📊 China’s Caixin Manufacturing PMI jumps to 50.8, its highest since November, lifting sentiment in Asia. Meanwhile, today’s ISM Manufacturing PMI will be key for U.S. markets. 🇪🇺 Eurozone inflation eases to 2.4%, slightly above expectations—markets now turn to Thursday’s ECB meeting, where further easing is anticipated. Markets are moving fast—tune in to stay ahead. 🎧 Welcome to Palvatar Market Recap, your go-to daily briefing on the latest market movements, global macro shifts, and crypto trends—powered by Raoul Pal’s AI avatar, Palvatar. 🔹 Why tune in? Stay ahead of market-moving developments with concise, data-driven insights. 🔹 Who should listen? Traders, investors, and macro enthusiasts looking for real-time market intelligence. 🍌 Get your Banana Zone swag at the Real Vision merch store: https://shop.realvision.com Unlock the potential to showcase your brand to our global audience. Contact us at partnerships@realvision.com for advertising inquiries. Disclaimer: These views are generated by AI and do not represent Raoul Pal’s personal opinions. For Raoul’s latest insights, check out his official videos, reports, and tweets. Connect with Raoul: Twitter (X): https://twitter.com/RaoulGMI Instagram: https://www.instagram.com/raoulgmi/ LinkedIn: https://www.linkedin.com/in/raoul-pal-real-vision/ Connect with Real Vision™ Online: Twitter: https://rvtv.io/twitter Instagram: https://rvtv.io/instagram Web: 🔥 https://rvtv.io/3Y4t5Pw Disclaimer: https://media.realvision.com/wp/20231004185303/Disclaimer-1.pdf Learn more about your ad choices. Visit podcastchoices.com/adchoices

3 Maalis 4min