Election Day Results, Dr. Phil, 877-29-STEVE, Gratitude 4 Voters and more.

Support the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

6 Marras 20241h 27min

Election Day 2024, Howard University, Jaime Harrison Interview, Project 2025 and more.

Support the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

5 Marras 20241h 25min

Election Day Eve, Kamala Harris Interview, SNL VP Cameo, Pimpin's Picks and more.

Support the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

4 Marras 20241h 26min

Kamala Counts Down, Roscoe Wallace, Malia Obama, Pimpin' NFL Week 9 and more.

Support the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

1 Marras 20241h 27min

Jennifer Lopez, Halloween Memories, Undecided Voters, Los Angeles Dodgers Champions and more.

Support the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

31 Loka 20241h 27min

VP Kamala Harris Interview, World Series 3-1, National Unity Vote, steveharveyfm.com and more.

Support the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

30 Loka 20241h 26min

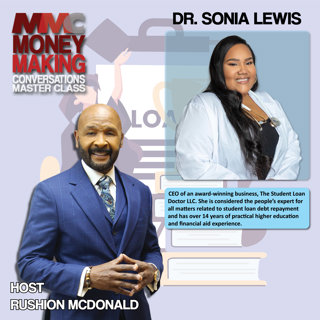

Mastering Your Money: Fix Your Credit, Learn Fraud Protection, and gain Financial Freedom with Experian.

Two-time Emmy and Three-time NAACP Image Award-winning, television Executive Producer Rushion McDonald interviewed, Rod Griffin. Rod Griffin. He is the Senior Director of Public Education and Advocacy at Experian, to unpack the essentials of financial health and identity protection. Griffin dives into savvy strategies for improving your credit score, understanding fraud prevention, and managing personal finances for lasting success. This episode is a must-listen for anyone looking to take control of their financial future and gain peace of mind in today’s digital world. Perfect for listeners eager to unlock financial freedom and protect what matters most. Talking Points/Questions * From your perspective and career in the financial services industry, what does it mean to be financially savvy? What role does credit play in a consumer’s overall financial health? What are some of the common misconceptions about credit and credit scores? What advice would you give to someone who is looking to establish or rebuild their credit history? Many people know your credit score can impact your ability to access credit cards, loans, etc. but what else can your credit history influence? What are ways consumers can save on everyday expenses like car insurance? What are your top tips for people looking to be more financially savvy in 2025? What tools and resources are available from Experian for consumers who are looking to improve their overall financial health and save money? #BEST #STRAW #SHMSSupport the show: https://www.steveharveyfm.com/See omnystudio.com/listener for privacy information.

30 Loka 202427min