20VC: Who Wins the AI Race; Startups or Incumbents & Does Having Proprietary Data Really Matter For Startups Today?

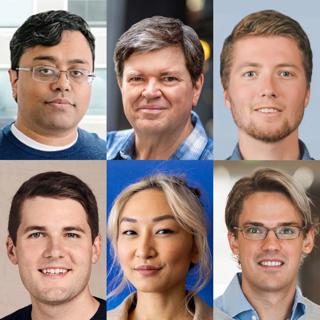

One of the core questions in AI and investing today; who wins, startups or incumbents? Startups have speed and innovation but incumbents have scale, resources, and distribution? Today we hear from 6 leading investors and founders discussing where they place their bets who has the advantage; startups or incumbents? Emad Mostaque is CEO @ StabilityAI, the parent company of Stable Diffusion. To date, Emad has raised over $110M with Stability with the latest round reportedly pricing the company at $4BN. Yann LeCun is VP & Chief AI Scientist at Meta and Professor at NYU. He was the founding Director of FAIR and of the NYU Center for Data Science. Clem Delangue is the Co-Founder and CEO @ Hugging Face, the AI community building the future. Clem has raised over $160M from the likes of Sequoia, Coatue, Addition and Lux Capital to name a few. Sarah Guo is the Founding Partner @ Conviction Capital, a $100M first fund purpose-built to serve "Software 3.0" companies. Prior to founding Conviction, Sarah was a General Partner at Greylock. Vince Hankes is a Partner @ Thrive Capital where he has led the firm's investments in OpenAI, Melio, and Airplane.dev. Prior to Thrive, Vince learned the craft of venture from Lee Fixel @ Tiger. Tomasz Tunguz is the Founder and General Partner @ Theory Ventures, a $230M fund that invests $1-25m in companies that leverage technology discontinuities into go-to-market advantages. The Question of the Day: Who wins? Startups or Incumbents?

2 Kesä 202324min

20VC: The On Running Memo: From Swiss Mountains to NASDAQ IPO: The Story of Three Friends Who Built a Sports Giant

David Alleman is the Co-Founder and Co-Chairman @ On Running one of the fastest-growing global sports brands with over 17 million products sold in 60+ countries. In 2021, On went public on the NASDAQ and today has a market cap of $8.7BN. However, it all started with three friends in the mountains experimenting with making shoes with pieces of garden hose to create a running shoe with a totally different feel. In Today's Episode with David Alleman We Discuss: 1. From the Swiss Mountains to NASDAQ IPO: What was the initial a-ha moment for David and his co-founders with On Running? How did they make the first shoes? What are some of the biggest lessons for David in V1 product build? What does David know now that he wishes he had known at the start? Is naivete always good? 2. The Launch: First Customers: How did On get their first customers? What can products and companies do to instill true customer love in those first customers? What was the hardest element of launching On to their first customers? How does David analyze and use customer feedback? What does he listen to vs not? 3. Retail: Expanding into Own Store vs Partnerships: What are some of David's biggest lessons in how to make retail partnerships successful? How can brands create amazing experiences for customers in retailers that are not their own? Why did On decide to also have their own stores? How did this change the business? What have been David's biggest learnings on what it takes to do retail well with own stores? 4. Roger Federer: Working with a Legend: How did the relationship with Roger begin? Where was the first meeting? What was it like? How did Roger come to invest in On Running? Why did On not want to do the traditional athlete endorsement deal? What role does Roger play in the company today? How does he impact product development? What have been some of the biggest lessons for David from working with Roger? How much of an impact has Roger had on On Running as a business? 5. Financing, IPOs, and Brand: Does David wish they had raised venture capital sooner? If they had more money sooner in their journey, what would David have invested in earlier? Why did they decide to go public when they did? How has the journey been post being a public company? What changes? What is the same? What brand does Davist most respect and admire? Why? What brand decisions does David most regret? What would he have done differently?

31 Touko 202344min

20VC: Why Financial Models at Seed, $5M Seed Rounds & The Fear of Signalling Risk is all BS | Why Multi-Stage Firms Have Destroyed Seed & Who Wins and Who Loses in the Next 10 Years of Venture with Adam Besvinick, Founding Partner @ Looking Glass Capital

Adam Besvinick is the Founder of Looking Glass Capital, a pre-seed-focused firm started in 2020. Before starting Looking Glass, Adam spent about 5 years at Deep Fork Capital and Anchorage Capital Group investing in pre-seed through Series C. Adam's portfolio across funds includes the likes of BigID, Transfix, NomNom, and Hone Health, to name a few. In Today's Episode with Adam Besvinick We Discuss: 1. How Twitter Led to Founding a Venture Firm: How did Adam make his way into the world of venture through Twitter? What are 1-2 of his biggest lessons from working with the legend, Chris Sacca? What does Adam know now that he wishes he had known at the beginning of his time in VC? What do most young VCs misunderstand when it comes to reputation? 2. Raising Fund I: The Process: How many LP meetings did Adam have to close Fund I? What docs and materials did he have for the fundraise? How does he advise other managers on doing docs for fundraises? How do different LP profiles want different things in the managers they work with? How did Adam approach first vs final close? How does he advise others managers on closing? How did Adam instil a sense of urgency in LPs to move and commit to the fund? What are 1-2 of Adam's biggest pieces of advice to managers raising a first-time fund? 3. Looking Glass: The Very Disciplined Pre-Seed Strategy: How did Adam decide on the fund size? Why is it the optimal fund size? What is the desired ownership for Adam? What level of dilution does he expect across the lifecycle of the company? What is the average check size? What is the average entry price? How does Adam approach reserves and follow-on checks? How does Adam reflect on his own relationship to price? Why does Adam not like the majority of pre-seed micro-fund strategies? 4. The Market: Multi-Stage Firms Destroying Seed Does Adam agree that "multi-stage firms have destroyed seed rounds"? How does Adam advise founders when they have multi-stage offers and seed firm offers? Who will be the winners and losers in the next 10 years of venture? Why is it harder than ever to advise founders on fundraising rounds today?

29 Touko 202343min

20Product: How Linkedin Does Product Reviews, A Post-Mortem on Stories, Linkedin Messenger and Spam & Why the Data Advantage in AI is Diminishing with Tomer Cohen, CPO @ Linkedin

Tomer Cohen is the CPO @ Linkedin. Since joining in 2012, Tomer has served in key leadership roles, helping launch and scale new innovative member and customer experiences. He previously led the growth and development of LinkedIn's Marketing Solutions portfolio and LinkedIn's consumer and mobile products. Prior to LinkedIn, Tomer worked as an entrepreneur with Greylock Partners and founded a company in the personal CRM space. In Today's Episode with Tomer Cohen We Discuss: 1.) From Israeli Military and Chip Design to CPO @ Linkedin: How did Tomer make his way from the Israeli military to being CPO @ Linkedin? What does Tomer know now that he wishes he had known when he became CPO? What have been some of his biggest lessons from working with Reid Hoffman? 2.) Product: Art or Science: How does Tomer determine whether product is art or science? If he were to put a number on it, what would it be? How does Tomer determine whether to go with his gut vs go with the data on product decisions? How is AI changing the role of product managers and product leaders? What do product leaders and PMs need to do to stay up to date with the latest changes in AI? 3.) Linkedin: Review of Current Products: Feed, Stories, Messenger How does Tomer analyse the success of "the feed" in Linkedin? What worked? What did not work? Why did "Stories" not work in Linkedin? What went wrong? What did they learn? What is Tomer doing to tackle the spam issue in Linkedin? What are the biggest challenges associated? Why does Linkedin still have such poor messaging service? Why is it a difficult problem to solve for? 4.) AI Changes Everything: Why does Tomer believe this wave of AI is the most significant technological shift in our lifetime? Who will win the race in AI; startups or incumbents? Which model will work most efficiently; open or closed? Will we see large enterprises prefer bundled AI options or unbundled with specialised providers?

26 Touko 202345min

20VC: Why Being First To Market Does Not Matter, Why You Do Not Have Defensibility on Day 1, How to Analyse Market Size and Present it to Investors, Vitamins vs Painkillers; Do Vitamins Survive Recessions and Good vs Great Messaging with Guy Podjarny @ Sn

Guy Podjarny is the Founder of Snyk, the leading Developer Security platform, helping developers secure as they build. Guy was previously CTO at Akamai, co-founded Blaze.io (acquired by Akamai), and was the product manager of AppScan, the first AppSec scanner, through Sanctum, Watchfire and IBM. Guy is a public speaker, O'Reilly author, and an active early stage angel investor. In Today's Episode with Guy Podjarny We Discuss: 1.) From Israeli Military to Founding a $10BN Company: How Guy made his way into the world of startups from the Israeli military? What is Guy running away from? Why does he hate tribalism so much? Does Guy believe serial entrepreneurship is valuable or naivety of young founders is good? 2.) The Secret to Finding Product Market Fit: Why does Guy believe PMF is a poorly defined term? How does Guy define PMF? What are the single biggest mistakes founders make while searching for PMF? What are the most important elements on messaging when it comes to PMF? If you have a horizontal tool, how do you message and resonate with specific audiences? 3.) Defensibility and Being First to Market: Does Guy believe that being the first to market is really that valuable? Does Guy agree that investors expecting defensibility on day 1 is wrong? Why does Guy think market leadership is way more important than first to market? What are the true defensible moats that can be built early today? 4.) Lessons from 100 Angel Investments: What have been the single biggest lessons for Guy from his 100 angel investments? What are the biggest mistakes angels make when investing today? How should founders present their market size to investors? Where do they go wrong? Does Guy invest in both painkiller and vitamin businesses? How does he compare them? Why is Boldstart Guy's favorite venture capital firm?

24 Touko 202358min

20VC: Why Your Fund Model Should Not Rely on $10BN+ Outcomes, Why the Large Funds Got Too Large, The Rise of Solo GP's; The Pros and Cons & Is Consumer Subscription Even a Good Sector to Invest in with Nico Wittenborn @ Adjacent

Nico Wittenborn is the Founder of Adjacent, one of the best early-stage firms created over the last 5 years. Before starting Adjacent, Nico spent over 3 years at Insight Partners in New York and before that learned the craft of venture from some of the best in early-stage, Point Nine, where he spent over 4 years. Nico's portfolio across funds includes the likes of Revolut, Chainalysis, Oura, RevenueCat and PhotoRoom to name a few. In Today's Show with Nico Wittenborn We Discuss: 1.) From Selling Mobile Phones to Leading Early-Stage Investor: How did Nico first make his way into the world of venture with Point Nine? What did Nico learn from his time with Point Nine and Insight? How did his time at each impact how he invests and runs Adjacent today? What does Nico know now that he wishes he had known when he started investing? 2.) Is Consumer Subscription Even a Good Place to Invest? With Calm ($2BN) and Duolingo ($6BN) as the market leaders and there only being two of them, is consumer subscription even a good place to invest? How does Nico pushback that retention for consumer subscription apps is so bad? What do many not see about consumer subscription retention numbers? How does Nico respond to the challenge of high customer acquisition cost and navigating challenging platform shifts in advertising, when investing in consumer subscription? What will the consumer subscription landscape look like in 5 years time? 3.) Adjacent: The Fund, The Strategy: Why does Nico believe if your fund model relies on $10BN outcomes, you are in trouble? How large is the latest Adjacent fund? What does the portfolio construction look like for the fund? How much diversification is the right level of diversification? How many companies per fund? How does Nico think about capital concentration on a per company basis? What are Nico's ownership requirements? How have they changed with funds? What is it about Nico's structure which enables him to be more collaborative than others? 4.) Nico: The Investor: Lessons: How does Nico reflect on his own relationship to price? When does he pay up? When does he not? What has been one of Nico's biggest misses? How has that changed his approach? Why does Nico not really compete with the large multi-stage funds? Why is Nico deliberately trying to reduce the amount of companies that he sees? 5.) The Future of Venture: How does Nico analyze the rise of solo GPs? What are the biggest pros and cons of the model? Why does Nico believe the large generalist funds are in trouble? Who is set to win and who is set to lose in the next 10 years of venture? Which seed firm would Nico invest in? Which Series A firm? Which growth firm?

22 Touko 20231h 6min

20Growth: Three Growth Lessons Scaling Whatsapp from 0-100M, Why You Should Hire a Head of Growth Sooner Than You Think & The Biggest Mistakes Founders Make When Hiring for Growth with Ryan Wiggins, Head of Growth @ Mercury

Ryan Wiggins is the VP of Growth and Analytics at Mercury where he oversees a Growth team and founded the Analytics function. Prior to this, Ryan built Growth teams at WhatsApp, where he helped grow WhatsApp Business from 0->100M users, Workplace, and Facebook Ads. If that was not enough, Ryan is also an active angel investor. In Today's Episode with Ryan Wiggins We Discuss: 1.) From US Department of Commerce to Leading Growth Teams: How Ryan made his initial foray into the world of growth with Facebook and Whatsapp? What does Ryan know now that he wishes he had known when he made the entry into growth? What advice does Ryan have for people who want to change their career but are not sure what they want to do? 2. ) Who and When: Building the Team: Should we hire a Head of Growth or a more junior growth hire first? What are the different profiles of growth hires? How do they change with business model? When is the right time to hire your first growth hire? What are the single biggest mistakes founders make on the timing of growth hires? 3.) How to Hire: The Process: Structurally, what is the right way to hire for a growth team? What does the interview process look like? What do you want to get out of each meeting? Should case studies be used, if so, should they be used for the company hiring or of the company where the candidate is from? What does the comp package look like for different growth hires? Who should be brought into the growth hiring process? What stage should they be involved? 4.) Onboarding: Setting Growth Up for Success: What is the ideal first 30,60 and 90 days for new growth hires? What can leaders do to ensure they are set up for the maximum chance of success? What are three of the biggest red flags bad growth hires show in the first 30 days? What are the biggest mistakes founders make in the onboarding process of growth hires?

19 Touko 202347min

20VC: Why the AI Bubble Will Be Bigger Than The Dot Com Bubble, Why AI Will Have a Bigger Impact Than COVID, Why No Models Used Today Will Be Used in a Year, Why All Models are Biased and How AI Kills Traditional Media with Emad Mostaque, Founder & CEO @

Emad Mostaque is the Co-Founder and CEO @ StabilityAI, the parent company of Stable Diffusion. Stability are building the foundation to activate humanity's potential. To date, Emad has raised over $110M with Stability with the latest round reportedly pricing the company at $4BN. Investors include Coatue, Lightspeed, Sound Ventures, OSS Capital and Airstreet Capital, to name a few. Prior to Stability, Emad was in the world of hedge funds, that was until his son was diagnosed with autism and he left to make a difference in the space and help find treatments and solutions. In Today's Episode with Emad Mostaque We Discuss: 1.) From Hedge Funds to Finding Treatments for Autism to Leading the World of AI: How Emad made his way from the world of hedge funds to founding one of the leading AI companies of our time? How did Emad find a solution to parts of his son's autism with a $6 drug? How does Emad believe we can use AI to solve the majority of medical problems today? What does the future of healthcare look like with AI at the centre? 2.) Models: What is Real? What is False? Why no models today will be used in a year? Why all models are biased and how do we solve for it? Why hallucinations are a feature and not a bug? Why the size of your model does not matter anymore? Why will there be national models specified to cultures and nations? How is this implemented? 3.) Who Wins: Startups or Incumbents: Why does Emad believe there will only be 5 really important AI companies? Which will they be? How does Emad review Google's AI strategy following their news last week? Was their integration of Google and Deepmind recently a success? How does Emad assess Meta's AI strategy? Why does Zuckerberg now acknowledge the metaverse play was a mistake? How does Emad evaluate the approach taken by Amazon? Why are they the dark horse in the race? What can startups do to get a meaningful edge on the large incumbents? How do they compete with their distribution? 4.) The Next 12 Months: What Happens: Why does Emad believe the .ai bubble will be bigger than the dot com bubble? Why does Emad believe that the biggest companies built-in AI in the next 12 months will be services-based companies? How does the ecosystem look if this is the case? Why will India and emerging markets embrace AI faster than anyone else? What happens to economies that have large segments reliant on freelance work that AI replaces? Why will we see the death of many large content publishers and media companies? What does Emad mean when he says we will see the rise of "AI first publishers"? 5.) Open or Closed: What Wins: Why does Emad believe we must be open by default? Why does open win? Why does Emad side with Elon and believe we must pause the development of AI for 6 months? How does Emad evaluate the leaked memo from Google stating that neither Google nor OpenAI are ahead? What does this mean for the AI ecosystem? Where will the best AI talent concentrate? What do companies need to do to win the best talent?

17 Touko 20231h 6min