20VC: AI's Biggest Questions: The Commoditisation of LLMs, Open vs Closed: Who Wins, Model Size vs Data Quality, Why Google are Vulnerable and Apple are the Dark Horse

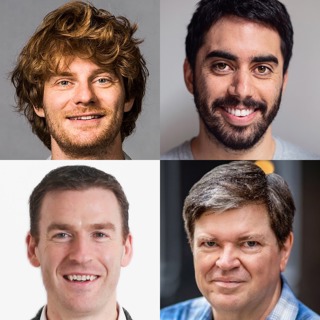

Des Traynor is a Co-Founder of Intercom, and has built and led many teams within the company, including Product, Marketing, and Customer Support. Yann LeCun is VP & Chief AI Scientist at Meta and Silver Professor at NYU affiliated with the Courant Institute of Mathematical Sciences & the Center for Data Science. He was the founding Director of FAIR and of the NYU Center for Data Science. Emad Mostaque is the Co-Founder and CEO @ StabilityAI, the parent company of Stable Diffusion. Stability are building the foundation to activate humanity's potential. Jeff Seibert is the Founder & CEO @ Digits, building the future of AI-powered accounting. Digits have raised funding from the likes of Peter Fenton @ Benchmark and 20VC. Tomasz Tunguz is the Founder and General Partner @ Theory Ventures, just announced last week, Theory is a $230M fund that invests $1-25m in early-stage companies that leverage technology discontinuities into go-to-market advantages. Douwe Kiela is the CEO of Contextual AI, building the contextual language model to power the future of businesses. Cris Valenzuela is the CEO and co-founder of Runway, the company that trains and builds generative AI models for content creation. Richard Socher is the founder and CEO of You.com. Richard previously served as the Chief Scientist and EVP at Salesforce. Before that, Richard was the CEO/CTO of AI startup MetaMind, acquired by Salesforce in 2016. In Today's Episode We Discuss: Foundational Models: Analysis Will foundational models become commoditized? Who are the major players? What are their different strengths? Who will win? Who will lose? How important is the size of the model vs the quality of the data? 2. Open vs Closed: What are the biggest pros and cons of an open ecosystem for LLMs? Why is it naive to think that open-source LLMs will prevail? What will determine which method wins? 3. An Analysis of the Incumbents: Why is Google the most vulnerable? What can they do to regain ground? Why is Apple the sleeping giant? How could they win the next wave of AI? What should Amazon do today to compete with Microsoft? 4. The Future: Doom and Gloom? Why is it ridiculous to assume AI systems want to dominate? Why will AI create a renaissance of creativity and human freedom? What role should regulation play in the advancement and progression of AI?

24 Marras 202333min

20VC: Why OpenAI Will Become an Infrastructure Play, Why Apple Will Win in an AI World, Why Google is the Most Vulnerable Incumbent, Will LLMs Be Commoditised, Which Startups Are Thin vs Thick Wrappers on Top of LLMs with Jeff Seibert, Founder @ Digits

Jeff Seibert is the Founder & CEO @ Digits, building the future of AI-powered accounting. Digits have raised funding from the likes of Peter Fenton @ Benchmark and 20VC. Jeff previously served as Twitter's Head of Consumer Product, a position he came to following the acquisition of his prior company, Crashlytics. Today, Crashlytics is the de-facto mobile crash reporting solution for iOS and Android and runs on over 6 Billion monthly active smartphones worldwide. In Today's Episode with Jeff Seibert We Discuss: 1. The Art of the Pivot: What are Jeff's biggest pieces of advice to founders pivoting? How do you know when you have enough data to make the decision to pivot? What are the single biggest mistakes founders make when pivoting? 2. AI: Who Wins and Who Loses: Why does Jeff believe that OpenAI will transition into an infrastructure play? What are the most significant challenges OpenAI will face moving forward? Why does Jeff believe that Apple are best positioned to win in an AI world? Why does Jeff believe that Google are the most vulnerable incumbent? What would Jeff do if he was CEO of Google? 3. LLMs: What Happens Now: Will we see the commoditization of LLMs? What are the biggest misconceptions people have on training and fine-tuning LLMs? Will we see LLMs increasingly specialise to vertical-specific models or will they remain horizontal? What is the difference between a thick and a thin wrapper when building on top of LLMs? 4. Angel Portfolio in Review: How many angel checks has Jeff written? How many failed? How many home runs? Does Jeff believe that company valuations are being kept artificially high? How did Jeff make 200x selling through the secondary market for a now failing company? What are Jeff's three biggest pieces of advice for angels today?

22 Marras 202358min

20VC: The Ultimate Hiring Playbook: Five Questions to Ask Every New Hire | What Makes Truly Great Leaders and How They Give Feedback | Do VCs Really Add Value; Lessons from Hard Fundraises with Matteo Franceschetti, Co-Founder @ Eight Sleep

Matteo Franceschetti is the Co-Founder and CEO @ Eight Sleep, a company dedicated to fueling human potential through optimal sleep. To date, Matteo has raised over $160M for the business from the likes of Founders Fund, Ryan Petersen, Naval Ravikant, Kevin Hart, AROD and many more. In Todays Episode with Matteo Franceschetti We Discuss: 1. Why Did Sleep Need "Solving": Why did Matteo decide he wanted to spend decades of his life-solving sleep? If Matteo has known how hard it was going to be, would he do it again? What does Matteo know now that he wishes he had known at the start of the journey? 2. Hiring the Best Team: What is Matteo's playbook for hiring? What are the five questions that Matteo asks in every interview? What are big red flags? What are strong signals of great talent? If people have been let go in a RIFF, is that a concern? How does Matteo construct hiring panels? What vote count is enough for an approved hire? What are Matteo's biggest lessons on title and pay a new hire receives? What are some of Matteo's biggest lessons when it comes to firing people? 3. Funding the Business: What was the hardest round to raise? Why? Are investors justified in their skepticism of hardware? What are the single biggest pieces of advice Matteo would give to founders on raising? How impactful has it been having Keith Rabois and Founders Fund as an investor? Do VCs really add value? 4. Mastering Health, Sleep and Nutrition: How does your diet impact the quality of sleep you have? How does exercise and the time of exercise impact your sleep? What are some common rules on sleep that are BS and myths? What are some of the most non-obvious truths about getting great sleep?

20 Marras 20231h 39min

20VC Will Seed Pricing Remain High | Where is the Funding Crunch? | Three Core Elements Required to Raise a Series B/C | Why AI is Like the Lottery Today | Why Now is the Best Time to be Investing in Crypto | Why Investors Do Not Want to Reprice Companies

Rebecca Kaden is a Managing Partner @ Union Square Ventures, one of the leading early-stage firms of the last decade with investments in Twitter, Twilio, Coinbase and many more. Nicole Quinn is a General Partner @ Lightspeed where she has led investments or sits on the board of Calm, Cameo and LunchClub to name a few. Eurie Kim is a Managing Partner @ Forerunner Ventures, the leading early-stage consumer fund. Eurie has led investments and sits on the board of Oura, The Farmers Dog, Curology and more. In Today's Roundtable We Discuss: 1. Seed Rounds: Is it even possible for traditional seed funds to play in a world of multi-stage funds investing so aggressively at the seed stage? Is seed immune to the macro environment? Will seed pricing remain as high as ever? What advice does the team have for seed founders approaching a Series A? What do they need? 2. Series A: How is the Series A market looking today? Is there a crunch at the Series A? To what extent are valuations compressed at the Series A? What 3 core elements do companies at the A stage, looking for a Series B next, need to focus on? 3. Series B and Beyond: Is the real crunch at the Series B? Why are down rounds so much better than structured rounds for companies raising? Will we see a wave of M&A in the next 12 months? 4. Crypto, AI and Hot Takes: Why is now the best time to be investing in crypto? Why is investing in AI a lottery right now? What is the most controversial thing that each believes today?

17 Marras 202340min

20VC: How to Survive and Thrive in a World of OpenAI, Are LLMs Being Commoditised, Where Does the Value Lie; Infrastructure or Application Layer, How Apple Could Win in a World of AI, How Amazon Could Threaten OpenAI and Why Google Struggle with Des Trayn

Des Traynor is a Co-Founder of Intercom, and has built and led many teams within the company, including Product, Marketing, and Customer Support. Today Des leads all Intercom's R&D efforts, and parts of Intercom's marketing. In Today's Episode with Des We Discuss: 1. From Consultancy to Founding a Unicorn: What was the founding a-ha moment for Des and the team with Intercom? Why does Des believe that most startup advice is BS and outdated in 5 years? What does Des know now that he wishes he had known when he started? 2. LLMs: The World is Not Equal: What does Des mean when he says the world of LLMs is not equal? How do the different LLMs very in quality, price and speciality? Does Des agree with Alex @ Nabla, "the best companies in the future will work with many LLMs at the same time and switch between them for different things"? To what extent does Des believe LLMs will be commoditised and it will be a race to the bottom? Would Des be a buyer of OpenAI at a $90BN price? Why not? 3. How to Survive in a World of OpenAI: What two simple questions will determine if Open AI will kill your existing business? What 3 criteria will determine if there is a new business to be built on top of OpenAI? What is the different between a thin layer on top of an LLM and a thick wrapper with real value? Which traditional incumbents are most vulnerable? What should they do in this new world? How long does it take for incumbents to really be impacted? 4. The Titans of Tech: Who Wins: Why does Des believe that Apple could be a massive winner in the next wave of AI? Why does Des believe that Google have not been impressive and failed to keep pace? Why does Des think OpenAI should be wary of Amazon? What could they do to threaten them? What opportunity does Facebook have here? How could Instagram and Whatsapp win? 5. Startup and Investing 101: Why does Des believe that every founder should write a blog post per week? Why does Des believe that most B2B marketing sucks? What makes great B2B marketing? What are Des' biggest lessons from the Hopin journey? How has Des' angel investing changed in the last year with the rise of AI?

15 Marras 20231h 18min

20VC: Flexport's Ryan Petersen: Reflections on Leadership from 13 Years Leading Flexport, Why Velocity not Speed is Most Important in Company Building, How Money Creates Inefficiencies in Scaling, The Future of Trade with China & Why Remote Work is so Cha

Ryan Petersen is Founder & CEO @ Flexport, a leader in global supply chain technology. In 2022, Flexport moved more than $26 billion of merchandise. Over the last 10 years, Ryan has raised close to $2.5BN for the business with the latest valuation pegging the business at $8BN. Prior to starting Flexport, Ryan was the founder and CEO of ImportGenius, a premier provider of transaction data for the global trade industry. In Today's Episode with Ryan Petersen We Discuss: 1. The Origins of a Generational Defining Leader: What did Ryan want to be when he was growing up? How did scooters and motorbikes in China lead to the idea for Flexport? What does Ryan know now that he wishes he had known when he started Flexport? 2. Speed and Money: The Secrets To Execution: Does Ryan believe speed is key to execution? What is the difference between speed and velocity? What advice does Ryan have to founders who raise a lot of money? How should it impact hiring? What are the most common ways founders become inefficient post-fundraising? Why does Ryan look to invest in founders with jaded pasts and a chip on their shoulder? 3. The Art of Resource Allocation: Are the best CEOs the best resource allocators? What is the single best resource allocation Ryan has made? What did he learn? What is the worst? What did he learn? What have been Ryan's biggest hiring mistakes? How did that change his approach? 4. The Wider World: Is Ryan long or short on China? Why? Will we see global trade become nationalized? Why? Will we see interest rates raised further? What impact does that have on trade? What has been the impact of war on trade and the shipping industry? 5. Ryan Petersen: The Father and Husband: How has having kids changed how Ryan approaches leadership and management? How does Ryan juggle 2 young kids and leading a 2,500 person company? How does Ryan retain romance with his wife while also being a full-on CEO of a large co? Does money make you happy? What does it help with? What does it not help with?

13 Marras 202357min

20Sales: Five Lessons Scaling Snowflake to $1BN ARR, Why Customer Success is BS and Should Be Removed, Why All Sales Reps Should Do Eight Calls Per Week & Why You Should Hire a Head of Sales Sooner Than You Think with Chris Degnan, CRO @ Snowflake

Chris Degnan serves as Snowflake's Chief Revenue Officer and has been with the company since 2013. Starting as employee #13 and Sales employee #1, Chris built a go-to-market strategy from the ground up, driving sustained high growth and global reach. Under his sales leadership, Snowflake has grown its annual product revenue from $0 to over $1 billion. Prior to Snowflake, Chris served in Sales leadership roles at EMC and Aveksa, and worked in enterprise sales at Informatica and Covalent Technologies (acquired by VMware). In Today's Episode with Chris Degnen We Discuss: 1. From SDR To World Leading CRO: How did Chris first make his way into the world of sales? What does he know now that he wishes he had known when he started in sales? What are the single biggest mistakes young sales people make today scaling their careers? 2. The Secret to Hitting Quota in Sales: Why does Chris believe all reps need to do 8 customer calls per week? How do the best sales reps approach sales prospecting today? Is cold outbound dead? How does Chris advise his teams on cold calls and emails? What are the best reasons reps should say no to customers? Should reps be discounting today? What is an acceptable level? 3. Sales and Product: The Most Important Relationship: Why does Chris believe sales and product is the most important relationship? What can leaders do to ensure sales and product communicate effectively? How does Chris use sales calls today both with his sales team and with product? What are the single biggest reasons comms between sales and product breaks? 4. Mastering Sales Leadership: How does Chris approach sales forecasting? What works? What does not work? Does Chris celebrate when quota is hit? How do you find the balance between pushing further and harder but also celebrating the wins? How do the best sales leaders train and develop their talent? What do the worst do? 5. Customer Success is BS: Professional Services for the Win: Why does Chris believe that customer succeed is BS and you should get rid of it? Why are professional services so much better? How should the org be structured then when removing CS and adding professional services? Who is then responsible for upsell?

10 Marras 202357min

20VC: From Leading the BBC to Leading Venture Capitalist, The Biggest Similarities and Differences Between the Best Founders and the Best Actors & The Future of Media; Legacy vs New, The Creator Economy, The Rise of TikTok and more with Danny Cohen

Danny Cohen is the President of Access Entertainment, a division of Len Blavatnik's Access Industries. Access Entertainment's corporate investments include film and television studio A24; Europe's fastest-growing company Tripledot Studios; creator economy leader Spotter; and a new immersive arts' experience launched in collaboration with David Hockney and Lightroom. Before joining Access, Danny was the Director of BBC Television where he had responsibility for all of the BBC's network channels and the greenlighting and production of the BBC's drama, entertainment, comedy, arts, history, science, educational content and documentary. In Today's Episode with Danny Cohen We Discuss: 1. From Leading the BBC to Investing for Len Blavatnik: How did Danny make his way from leading the BBC to investing for Len @ Access? What was he most nervous about when making the transition to investing? What has been the hardest investing skill to learn? 2. Great Founders are Like Great Actors: What are the biggest similarities in what makes the best founders and the best actors? How are the best founders different from the best actors? Why does Danny believe the risk that an actor takes is so different to the risk founders take? How does Danny feel both founders and actors can and should be managed? 3. The Future of Media: What does Danny mean when he says he looks for "eyeballs and attention" when investing? How does legacy media respond to the threat created by social media today? How does AI change the future of content creation and distribution today? How do the strikes in Hollywood impact the future of content supply? 4. Marriage, Children and Loneliness: Why does Danny believe that loneliness will continue to be the biggest problem we face? What are Danny's biggest pieces of advice from 17 years of happy marriage? Why did Danny decide to not have children? What did that decision-making process look like?

8 Marras 202350min