20VC: UK Prime Minister, Rishi Sunak on Investing More in AI Safety Research Than Any Other Country in the World, How AI Changes the Future of Education, His Top 5 Priorities as Prime Minister Today & How to Make the UK the Centre of AI

Rishi Sunak is the Prime Minister of the United Kingdom. He was previously appointed Chancellor of the Exchequer from 13 February 2020 to 5 July 2022. He was Chief Secretary to the Treasury from 24 July 2019 to 13 February 2020, and Parliamentary Under Secretary of State at the Ministry of Housing, Communities and Local Government from 9 January 2018 to 24 July 2019. Before entering the world of politics, Rishi co-founded an investment firm. In Today's Episode with Rishi Sunak We Discuss: 1. The United Kingdom: Open for AI: Open for Business Why does Rishi believe the UK is best placed to lead the way for innovation in AI? What can the government do to ensure the public and private sectors work together most efficiently? Why has Rishi created an entirely new division just for this? How does this change how decisions for AI and technology are made? 2. $100M Funding: The Largest Government Funding in the World: Why did Rishi decide to allocate the largest pool of capital of any nation toward AI safety? What is the strategy for the $100M? How will it be invested? Who will manage it? What are the challenges and opportunities in setting up this $100M funding program? 3. Education: Attracting the Best in the World: What has Rishi done to ensure the best talent in the world, wants to and can work in the UK? What new initiative has Rishi put in place to ensure the world's brightest students can freely move to and work in the UK? What can be done to ensure the UK continues to foster the same level of homegrown talent that we always have done? What can we do to improve our current education system for AI even further? Why does Rishi believe one of the greatest opportunities for AI lies in education and teaching? 4. Making Regulation Work Effectively: How does Rishi think about creating regulation which is both effective and not prohibitive? What can we do to create a government that moves at the speed of business? What does Rishi believe are the biggest mistakes made in regulatory provisions? What are we doing to avoid them with AI in the UK?

14 Jun 202321min

20VC: Larry Summers on How to Manage Inflation; Should We Increase Rates Even Higher, Why We Need To Change The US Tax System, Why Europe is a Museum, China is a Jail and Bitcoin is an Experiment & How a Trump Win Would Hurt the US Economy

Larry Summers is the Former Treasury Secretary and one of America's leading economists. In addition to serving as 71st Secretary of the Treasury in the Clinton Administration, Dr. Summers served as Director of the White House National Economic Council in the Obama Administration, as President of Harvard University, and as the Chief Economist of the World Bank. Huge thanks to Sarah Cannon for the intro to Larry today. In Today's Episode with Larry Summers We Discuss: 1. The Journey to Being One of the World's Leading Economists: How Larry's mother and father both being economists shaped his early thinking as an economist? How did Larry's parenting teach his children economics at an early age? What does Larry know now that he wishes he had known when he entered the workforce? 2. How to Get the US Out of Debt: What would Larry do to save the US economy today? What can be done to increase revenues for the US economy? Why does Larry believe carried interest should be taxed as income tax? Why does Larry believe we need more billionaires? How would he tax them more efficiently? Why does Larry believe cutting taxes is indefensible? What can be done to reduce inflation without massively hurting the poorest in society? 3. The World Around Us: What does Larry mean when he says, "Europe is a museum, China is a jail and Bitcoin is an experiement"? Why does Larry believe the next 5 years will be difficult for China? Why does Larry believe the next 5 years will be challenging for Europe? Which nation is Larry most confident about when projecting forward for the next 5-10 years? 4. Politics and a Trump Administration: How does Larry reflect on the role of Biden on the US economy and state of inflation? Would a Trump administration be better or worse for the US economy? What are the chances of Trump beating Biden in the next election? What would Larry most like to change about the US political system?

12 Jun 202340min

20VC: What are the World's Tech Leaders Running From? Fear? Insecurity? Poverty? What Drives the Best with Orlando Bravo, Bill Ackman, Dara Khosrowshahi, Parker Conrad, Tobi Luttke, Brian Armstrong and more..

Orlando Bravo is a Founder and Managing Partner of Thoma Bravo. He led Thoma Bravo's early entry into software buyouts and built the firm into one of the top private equity firms in the world. Tobi Lütke is the CEO and Co-Founder of Shopify, the powerhouse company allowing anyone to start and grow their e-commerce business. Dara Khosrowshahi is the CEO of Uber, where he has managed the company's business in more than 70 countries around the world since 2017. Parker Conrad is the Founder & CEO @ Rippling, the company that lets you easily manage your employees' payroll, benefits, expenses, devices, apps & more—in one place. Jamie Siminoff is the Founder and Chief Inventor @ Ring, with Ring Jamie, created the world's first Wi-Fi video doorbell while working in his garage in 2011. The company sold to Amazon for $1BN. Martín Escobari is Co-President, Managing Director and Head of General Atlantic's business in Latin America. Martín is Chairman of the firm's Investment Committee and also serves on the Management and Portfolio Committees. Ariel Cohen is the Co-Founder and CEO @ Navan (formerly TripActions), the #1 travel management super-app used by over 8,000 companies. Tarek Mansour is the Founder and CEO @ Kalshi, the first regulated exchange where you can trade directly on the outcome of events. Brian Armstrong is the Co-Founder and CEO @ Coinbase, the easiest place to buy and sell cryptocurrency. Over the last 10 years, Brian has led Coinbase to today, a public company with over 3,500 employees and revenues of over $7.5BN in 2021. Question of the Day: What are the world's tech leaders running from?

9 Jun 202328min

20Sales: PLG and Early Adopter Sales are Gone, How to do Sales Forecasting in 2023, Why You Cannot Do PLG and Enterprise from Day 1 at the Same Time and Which is Easier to Start, How to Onboard, Manage and Scale Reps with Rich Liu, CRO @ Everlaw

Rich Liu is the CRO @ Everlaw and a unicorn GTM exec having scaled five multi-billion dollar tech unicorns across two IPOs, a successful acquisition, and numerous funding rounds. Prior to Everlaw, Rich architected the GTM motions for companies like Navan (TripActions), MuleSoft, and Meta (Facebook). As a result of his incredible success, Rich has been recognized as a 2021 Top 100 Global Sales Leader. In Today's Episode with Rich Liu We Discuss: 1. Entry into the World of Sales: How Rich made his way from biochemistry into the world of sales? What is 1 takeaway from his time at Navan, Meta and Mulesoft that has shaped how he thinks about sales today? What does Rich know now that he wishes he had known when he entered the world of sales? 2. Sales Today: What is Happening? What are the biggest sales leaders saying today about price sensitivity and deal cycles? What has changed in the way companies buy software with the macro downturn? What do companies need to do to get deals over the line today? How do startups need to change the way they message to enterprises in order to sell today? How has the renewals process changed? What does this mean for customer success teams today? 3. PLG vs Enterprise: When and How? Is it possible to do both PLG and enterprise at the same time? Is it easier to start with enterprise and move to PLG or visa versa? How does the type of sales leader you need change dependent on the motion? When is the right time to move from founder-led sales to sales team? How does one know whether to hire a junior jack of all trades or a senior sales leader? 4. How To Hire The Best in Sales: How does Rich structure the hiring process for all new reps today? Does he use case studies to determine their depth and ability? Is the case study of the company they are interviewing at or a fresh company? What questions does Rich ask every candidate for a new role? What are some of the biggest red and green flags in how candidates talk in interviews?

7 Jun 202351min

20VC: The Largest Venture Backed D2C Consumer Exit; PillPack: $0-$300M Revenues in 5 Years & The Biggest Lessons Scaling the B2B Business to $300M in 2.5 Years with TJ Parker, Co-Founder @ PillPack

TJ Parker is the co-founder and former CEO of PillPack. TJ Raised over $100M in financing, grew the company to more than 1k employees, and successfully sold the business to Amazon for $1B in 2018. As of last week, TJ was announced as the newest Partner @ Matrix Partners where he will initially focus on health opportunities from concept to series A. In Today's Episode with TJ Parker We Discuss: 1.) From Growing Up in Pharmacies to Selling to Amazon for $1BN: How did TJ seeing the pharmacy industry from his parents lead him to believe there was a $BN company to be built in the space? What does TJ know now that he wishes he had known when he started the company? What does TJ believe he is running from? How does that impact his own style of parenting? 2.) The Truth About Entrepreneurship: Why do the best founders have to get comfortable in an environment of uncertainty? What have been some of TJ's biggest lessons in how to do this? Why does TJ believe the role of the CEO is to set the vision and get out of the way? What roles can only the CEO do? How does TJ approach delegation? What have been some of his core lessons? Does TJ believe being naive is a superpower when starting a company? What do founders need to know vs what do they not need to know when starting a business? 3.) Speed of Execution and Decision-Making: How important does TJ believe speed of execution is for startups today? What can founders do to create a culture of rapid decision-making? What works? What does not? What does TJ believe are 1-2 of the single best and worst decisions he made with PillPack? What are some of the biggest mistakes TJ sees founders make both in speed of execution and then also in decision-making processes? 4.) The Crucible Moments: Lawsuits & Acquisitions: How did an incumbent come days away from shutting down PillPack? How did they save the company? How does TJ deal with those moments of intense stress? How did the Amazon acquisition come to be? Why and how did the prior acquisition fall through? Does TJ regret the sale to Amazon? How was life at Amazon post-acquisition?

5 Jun 202359min

20VC: Who Wins the AI Race; Startups or Incumbents & Does Having Proprietary Data Really Matter For Startups Today?

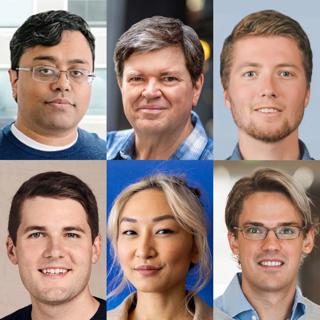

One of the core questions in AI and investing today; who wins, startups or incumbents? Startups have speed and innovation but incumbents have scale, resources, and distribution? Today we hear from 6 leading investors and founders discussing where they place their bets who has the advantage; startups or incumbents? Emad Mostaque is CEO @ StabilityAI, the parent company of Stable Diffusion. To date, Emad has raised over $110M with Stability with the latest round reportedly pricing the company at $4BN. Yann LeCun is VP & Chief AI Scientist at Meta and Professor at NYU. He was the founding Director of FAIR and of the NYU Center for Data Science. Clem Delangue is the Co-Founder and CEO @ Hugging Face, the AI community building the future. Clem has raised over $160M from the likes of Sequoia, Coatue, Addition and Lux Capital to name a few. Sarah Guo is the Founding Partner @ Conviction Capital, a $100M first fund purpose-built to serve "Software 3.0" companies. Prior to founding Conviction, Sarah was a General Partner at Greylock. Vince Hankes is a Partner @ Thrive Capital where he has led the firm's investments in OpenAI, Melio, and Airplane.dev. Prior to Thrive, Vince learned the craft of venture from Lee Fixel @ Tiger. Tomasz Tunguz is the Founder and General Partner @ Theory Ventures, a $230M fund that invests $1-25m in companies that leverage technology discontinuities into go-to-market advantages. The Question of the Day: Who wins? Startups or Incumbents?

2 Jun 202324min

20VC: The On Running Memo: From Swiss Mountains to NASDAQ IPO: The Story of Three Friends Who Built a Sports Giant

David Alleman is the Co-Founder and Co-Chairman @ On Running one of the fastest-growing global sports brands with over 17 million products sold in 60+ countries. In 2021, On went public on the NASDAQ and today has a market cap of $8.7BN. However, it all started with three friends in the mountains experimenting with making shoes with pieces of garden hose to create a running shoe with a totally different feel. In Today's Episode with David Alleman We Discuss: 1. From the Swiss Mountains to NASDAQ IPO: What was the initial a-ha moment for David and his co-founders with On Running? How did they make the first shoes? What are some of the biggest lessons for David in V1 product build? What does David know now that he wishes he had known at the start? Is naivete always good? 2. The Launch: First Customers: How did On get their first customers? What can products and companies do to instill true customer love in those first customers? What was the hardest element of launching On to their first customers? How does David analyze and use customer feedback? What does he listen to vs not? 3. Retail: Expanding into Own Store vs Partnerships: What are some of David's biggest lessons in how to make retail partnerships successful? How can brands create amazing experiences for customers in retailers that are not their own? Why did On decide to also have their own stores? How did this change the business? What have been David's biggest learnings on what it takes to do retail well with own stores? 4. Roger Federer: Working with a Legend: How did the relationship with Roger begin? Where was the first meeting? What was it like? How did Roger come to invest in On Running? Why did On not want to do the traditional athlete endorsement deal? What role does Roger play in the company today? How does he impact product development? What have been some of the biggest lessons for David from working with Roger? How much of an impact has Roger had on On Running as a business? 5. Financing, IPOs, and Brand: Does David wish they had raised venture capital sooner? If they had more money sooner in their journey, what would David have invested in earlier? Why did they decide to go public when they did? How has the journey been post being a public company? What changes? What is the same? What brand does Davist most respect and admire? Why? What brand decisions does David most regret? What would he have done differently?

31 Mai 202344min

20VC: Why Financial Models at Seed, $5M Seed Rounds & The Fear of Signalling Risk is all BS | Why Multi-Stage Firms Have Destroyed Seed & Who Wins and Who Loses in the Next 10 Years of Venture with Adam Besvinick, Founding Partner @ Looking Glass Capital

Adam Besvinick is the Founder of Looking Glass Capital, a pre-seed-focused firm started in 2020. Before starting Looking Glass, Adam spent about 5 years at Deep Fork Capital and Anchorage Capital Group investing in pre-seed through Series C. Adam's portfolio across funds includes the likes of BigID, Transfix, NomNom, and Hone Health, to name a few. In Today's Episode with Adam Besvinick We Discuss: 1. How Twitter Led to Founding a Venture Firm: How did Adam make his way into the world of venture through Twitter? What are 1-2 of his biggest lessons from working with the legend, Chris Sacca? What does Adam know now that he wishes he had known at the beginning of his time in VC? What do most young VCs misunderstand when it comes to reputation? 2. Raising Fund I: The Process: How many LP meetings did Adam have to close Fund I? What docs and materials did he have for the fundraise? How does he advise other managers on doing docs for fundraises? How do different LP profiles want different things in the managers they work with? How did Adam approach first vs final close? How does he advise others managers on closing? How did Adam instil a sense of urgency in LPs to move and commit to the fund? What are 1-2 of Adam's biggest pieces of advice to managers raising a first-time fund? 3. Looking Glass: The Very Disciplined Pre-Seed Strategy: How did Adam decide on the fund size? Why is it the optimal fund size? What is the desired ownership for Adam? What level of dilution does he expect across the lifecycle of the company? What is the average check size? What is the average entry price? How does Adam approach reserves and follow-on checks? How does Adam reflect on his own relationship to price? Why does Adam not like the majority of pre-seed micro-fund strategies? 4. The Market: Multi-Stage Firms Destroying Seed Does Adam agree that "multi-stage firms have destroyed seed rounds"? How does Adam advise founders when they have multi-stage offers and seed firm offers? Who will be the winners and losers in the next 10 years of venture? Why is it harder than ever to advise founders on fundraising rounds today?

29 Mai 202343min