20Product: Slack CPO Noah Weiss on How to Master Product-Led-Growth, The Biggest Mistakes Founders Make When Scaling Into Enterprise & What Needs to Change with your Product, Team and Processes when Scaling From PLG to Enterprise

Noah Weiss is the Chief Product Officer of Slack, overseeing the product team's strategy and development. Over his seven years at Slack, Noah has led various parts of the product organization, includi...

16 Juni 202351min

20VC: UK Prime Minister, Rishi Sunak on Investing More in AI Safety Research Than Any Other Country in the World, How AI Changes the Future of Education, His Top 5 Priorities as Prime Minister Today & How to Make the UK the Centre of AI

Rishi Sunak is the Prime Minister of the United Kingdom. He was previously appointed Chancellor of the Exchequer from 13 February 2020 to 5 July 2022. He was Chief Secretary to the Treasury from 24 Ju...

14 Juni 202321min

20VC: Larry Summers on How to Manage Inflation; Should We Increase Rates Even Higher, Why We Need To Change The US Tax System, Why Europe is a Museum, China is a Jail and Bitcoin is an Experiment & How a Trump Win Would Hurt the US Economy

Larry Summers is the Former Treasury Secretary and one of America's leading economists. In addition to serving as 71st Secretary of the Treasury in the Clinton Administration, Dr. Summers served as D...

12 Juni 202340min

20VC: What are the World's Tech Leaders Running From? Fear? Insecurity? Poverty? What Drives the Best with Orlando Bravo, Bill Ackman, Dara Khosrowshahi, Parker Conrad, Tobi Luttke, Brian Armstrong and more..

Orlando Bravo is a Founder and Managing Partner of Thoma Bravo. He led Thoma Bravo's early entry into software buyouts and built the firm into one of the top private equity firms in the world. Tobi...

9 Juni 202328min

20Sales: PLG and Early Adopter Sales are Gone, How to do Sales Forecasting in 2023, Why You Cannot Do PLG and Enterprise from Day 1 at the Same Time and Which is Easier to Start, How to Onboard, Manage and Scale Reps with Rich Liu, CRO @ Everlaw

Rich Liu is the CRO @ Everlaw and a unicorn GTM exec having scaled five multi-billion dollar tech unicorns across two IPOs, a successful acquisition, and numerous funding rounds. Prior to Everlaw, Ric...

7 Juni 202351min

20VC: The Largest Venture Backed D2C Consumer Exit; PillPack: $0-$300M Revenues in 5 Years & The Biggest Lessons Scaling the B2B Business to $300M in 2.5 Years with TJ Parker, Co-Founder @ PillPack

TJ Parker is the co-founder and former CEO of PillPack. TJ Raised over $100M in financing, grew the company to more than 1k employees, and successfully sold the business to Amazon for $1B in 2018. As ...

5 Juni 202359min

20VC: Who Wins the AI Race; Startups or Incumbents & Does Having Proprietary Data Really Matter For Startups Today?

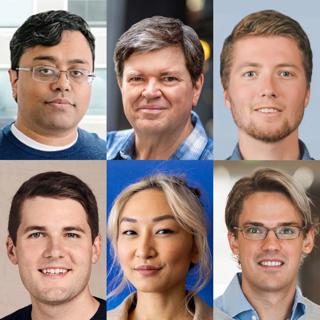

One of the core questions in AI and investing today; who wins, startups or incumbents? Startups have speed and innovation but incumbents have scale, resources, and distribution? Today we hear from 6...

2 Juni 202324min

20VC: The On Running Memo: From Swiss Mountains to NASDAQ IPO: The Story of Three Friends Who Built a Sports Giant

David Alleman is the Co-Founder and Co-Chairman @ On Running one of the fastest-growing global sports brands with over 17 million products sold in 60+ countries. In 2021, On went public on the NASDAQ ...

31 Maj 202344min