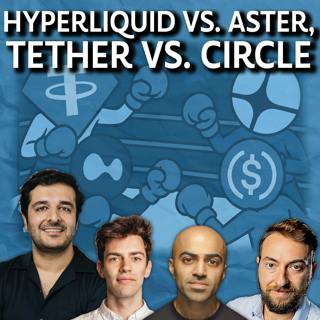

The Chopping Block: Perp Wars & Stablecoin Battles: Hyperliquid, Aster, Tether - Ep. 911

Welcome to The Chopping Block – where crypto insiders Haseeb Qureshi, Tom Schmidt, Tarun Chitra, and Robert Leshner chop it up about the latest in crypto. This week, we’re joined by Farooq Malik, co-founder and CEO of Rain, as two parallel wars erupt across crypto: the Perp DEX war between Hyperliquid and the CZ-backed Aster, and the deepening battle for stablecoin dominance. As Aster rockets to $30B in daily volume, we debate whether it’s real adoption or points-fueled froth — and what it means for Hyperliquid’s lead. Then we dive into Tether’s shocking $500B valuation play, Circle’s shrinking moat, and how Rain is building real-world rails for stablecoin payments. If crypto has two new battlegrounds — trading venues and money itself — this is where the future is getting drawn. Show highlights 🔹 DEX Wars: Aster vs. Hyperliquid – Aster hits $30B daily volume; is it real demand or a points-fueled surge? Hyperliquid’s dominance faces its first real threat. 🔹 CZ’s Return to Form – Aster’s Binance links, aggressive fee model, and possible “James Wynn” conspiracy theory raise the stakes in the perp DEX arena. 🔹 Wash Trading & Open Interest Gaps – Aster’s $2B TVL contrasts with $1.25B open interest vs. Hyperliquid’s $10B, sparking questions about organic traction. 🔹 Incentive Wars – Aster rewards takers 2x over makers; Hyperliquid and Blur praised for long-game design that built sticky liquidity instead of short-term volume. 🔹 The Execution Advantage – Haseeb: “Asia executes better than it innovates”; Aster may stumble now but could out-iterate and outscale its rivals. 🔹 Stablecoin Shockwave: Tether’s $500B Valuation Leak – Tether quietly seeks $15–20B in private funding, aiming for a $500B valuation—matching OpenAI and SpaceX. 🔹 Circle vs. Tether – Circle trades at 0.5x supply, Tether seeks 3x; the panel debates margins, moat, and whether USDC can survive the “reverse momentum.” 🔹 Rain’s Real-World Stablecoin Rails – Farooq Malik shares how Rain powers payroll, P2P, cards, and merchant payments on stablecoins—without touching fiat. 🔹 New Use Cases: Stablecoins in the Wild – On-chain credit cards, just-in-time lending, cross-border Facebook ad funding, and more—all enabled by 24/7 money. 🔹 Global Adoption: LatAm, MENA, Asia – Rain’s data shows stablecoin usage exploding outside the U.S., especially in regions with FX controls and unstable banks. Hosts ⭐️Haseeb Qureshi, Managing Partner at Dragonfly ⭐️Robert Leshner, CEO & Co-founder of Superstate ⭐️Tom Schmidt, General Partner at Dragonfly Guest ⭐️Farooq Malik, Co-Founder & CEO of Rain Disclosures Timestamps 00:00 Intro 01:02 Aster vs. Hyperliquid 14:25 Regulatory Capture: L2s, Sequencers, CFTC 26:08 Tether’s $500B Valuation: Bubble or Bargain? 31:36 Tether vs. Circle: Stablecoin Economics 42:56 Rain: Stablecoin Payments Infra 47:16 Stablecoin Use Cases; Cards, Payroll, P2P 54:04 Global Stablecoin Growth Learn more about your ad choices. Visit megaphone.fm/adchoices

26 Sep 1h 2min

Plasma's Successful Launch, Revenue Over TVL & the Future of Pump.fun - Ep. 910

How do stablecoin-first blockchains win distribution? Does TVL actually map to value? And why speculation may become the default language of online culture. In this 3-part episode, we explore three different important stories. Segment 1: CoinFund’s Seth Ginns explains how newly launched stablecoin chain Plasma aims to compete, plus why the “stablecoin race” with Circle and Stripe is just beginning. Segment 2: Solana Foundation president Lily Liu lays out why revenue—not TVL—should be crypto’s north-star metric, whether TVL can be easily gamed, and what a better DeFi metric stack looks like. Segment 3: Figment Capital’s James Parillo makes the case for Pump.fun and “AudienceFi”: how creator coins can financialize streaming, whether token collapses are a feature, and why both perps and memecoins rhyme with gambling. Thank you to our sponsors! TOKEN2049 - Get 15% off with code UNCHAINED Binance Guests: James Parillo, General Partner at Figment Capital Lily Liu, President of Solana Foundation Seth Ginns, Managing Partner and Head of Liquid Investments at CoinFund Learn more about your ad choices. Visit megaphone.fm/adchoices

26 Sep 1h 27min

Why Hyperliquid Should Cut Its Total Token Supply Nearly in Half - Ep. 909

Crypto investors love to throw around “FDV” as if it’s the ultimate measure of value. But what if that number is more misleading than helpful? In this episode, DBA’s Jon Charbonneau explains his proposal to cut Hyperliquid’s supply by nearly half, why he believes FDV overstates real valuations, and how outdated tokenomics are holding projects back. We also cover whether the Hyperliquid team should take smaller allocations if they cut the token supply and what Jon thinks of Arthur Hayes’ HYPE sale just weeks after saying the token would 10x. Visit our website for breaking news, analysis, op-eds, articles to learn about crypto, and much more: unchainedcrypto.com Thank you to our sponsor, Mantle! Guest: Jon Charbonneau, Co-founder and General Partner of DBA Links: Proposal to Reduce HYPE Total Supply by 45% by Jon Charbonneau, Co-founder of DBA Maelstrom post: HYPE's Damocles Sword Unchained: Nearly $12 Billion in HYPE Token Unlocks Loom Ahead: Maelstrom Timestamps: 🎬 0:00 Intro 📉 0:35 What Jon thinks people get wrong when they use FDV as a valuation metric 🧮 4:05 How Jon’s proposal would change Hyperliquid’s supply and valuation 🆘 12:20 If the Assistance Fund is removed, how can emergencies be handled? 📊 15:05 How token supplies should really be evaluated when valuing projects ⏳ 20:44 Why current tokenomics reflect an outdated model ✂️ 24:56 Should the Hyperliquid team be taking a smaller allocation too? 🤔 28:15 What Jon thinks of Arthur Hayes selling HYPE right after calling for the moon 🔮 31:351 How Hyperliquid should move forward with Jon’s proposal Learn more about your ad choices. Visit megaphone.fm/adchoices

24 Sep 36min

Bits + Bips: How Wall Street Could Make a Killing off the Next Crypto Winter - Ep. 908

Markets had a flood of liquidations on Monday, and traders lost over $1.5 billion in positions. So, why are liquidations spiking? Is this a warning or a blip? Also, could a flood of DAT issuance be setting the stage for not just a crypto winter, but a crypto “nuclear” winter? If so, hedge funds and market structure could accelerate the pain. This week on Bits + Bips, Steven Ehrlich, Ram Ahluwalia, Austin Campbell, and Vinny Lingham talk about why mNAVs could compress and whether even MicroStrategy’s stack is more fragile than it looks. They debate the bull case for gold (yes, even at these ATHs), how tokenized stocks and changing reporting cadences could open new insider edges, and what the U.S. macro picture looks like. Thank you to our sponsors! Walrus: Scalable storage that lets you publish, deliver, and program any data, onchain. Xapo: Where Global Banking Meets Bitcoin Hosts: Ram Ahluwalia, CFA, CEO and Founder of Lumida Steven Ehrlich, Executive Editor at Unchained Guests: Austin Campbell, Founder and Managing Partner of Zero Knowledge Consulting Vinny Lingham, Co-founder of Praxos Capital Timestamps: 🎬 0:00 Intro 💥7:39 Why Monday’s liquidations spiked and what triggered $1.5B in losses 📊 11:18 How a shift away from quarterly reporting could change markets 🕵️ 14:16 How tokenized stocks might hand insiders a massive edge 🐻 22:05 Why Vinny is bearish right now and why Ram disagrees 🥇 24:25 Why gold might still have upside, even at record highs 📉 28:59 Whether the flood of DATs will end in brutal consolidation ⚡ 35:49 Could even MicroStrategy blow up under market stress? ✅ 48:17 What SEC clearing the path for ETFs really signals for crypto 📈 54:23 Ram’s stock picks in this environment ⚠️ 56:00 Why Austin sees a looming breakdown in the U.S. economy 😌 58:02 Why Vinny doesn’t feel the need to take big risks right now Learn more about your ad choices. Visit megaphone.fm/adchoices

23 Sep 1h 1min

Debate: Should Stablecoin Chains Have an Ethereum L2 or Their Own L1? - Ep. 907

In this episode, Cyber Capital’s Justin Bons and Codex’s Haonan Li challenge the new orthodoxy: whether payments chains should be alt L1s or Ethereum L2s, how “neutrality” and finality matter for real-world transactions, and why fragmentation could make or break onchain dollars. We dig into Stripe’s Tempo (and its permissioned start), what it would take for L2s to reach true decentralization, and whether stablechains undercut general-purpose chains. Plus: the trade-offs of sequencers, paying gas in dollars, and whether protocol-native stables are the future. Thank you to our sponsors! Binance Token2049 – Get 15% off with code UNCHAINED Guests: Justin Bons, Founder and CIO of Cyber Capital Haonan Li, Co-founder and CEO of Codex Timestamps: 🎬 0:00 Intro 💭 1:45 Laying out the first arguments 🛠️ 12:57 What needs to happen for L2s to finally become stage 2 rollups 💵 15:40 Why Haonan chose to launch a stablecoin-focused L2 on Ethereum 🏦 30:17 Does Stripe’s Tempo L1 spell trouble for Ethereum L2s? ⚖️ 38:55 Whether Tempo can position itself as a neutral blockchain 🔗 50:02 Are L2s capable of true decentralization? ⏱️ 53:58 How important finality is for stablecoin businesses 🧩 57:08 Why fragmentation could make or break stablecoins 🔮 1:02:31 What the future of rollups should look like ⚔️ 1:05:58 The case for and against general-purpose chains 📉 1:13:12 Whether protocol-native stablecoins will keep gaining traction Learn more about your ad choices. Visit megaphone.fm/adchoices

19 Sep 1h 25min

The Chopping Block: Stablecoin-as-a-Service: The Next Big Crypto Gold Rush? - Ep. 906

Welcome to The Chopping Block – where crypto insiders Haseeb Qureshi, Tom Schmidt, Tarun Chitra, and Robert Leshner chop it up about the latest in crypto. This week, we’re joined by Gordon Liao, Chief Economist at Circle, to dissect the Stablecoin Wars. From Circle’s Arc and Stripe + Paradigm’s Tempo, to Solana’s native stablecoin push and Hyperliquid’s deal, we unpack why everyone suddenly wants their own chain or branded stablecoin. Is this the future of crypto’s monetary layer — or just a fragmentation nightmare? We dig into FX use cases, PMF for stablecoins, collective bargaining power of ecosystems, and whether “stablecoin-as-a-service” is the next killer primitive or a liquidity trap. Show highlights 🔹 Arc vs. Tempo — Circle’s Arc and Stripe + Paradigm’s Tempo: stablecoin-native L1s with permissioned validator sets, stablecoin gas, privacy, and FX engines. 🔹 Will FX Ever Matter? — Gordon: $9T/day FX market is broken; onchain FX could slash costs. Tarun + Haseeb question whether non-USD stables will ever get real traction. 🔹 Solana’s Stablecoin Gambit — Mert & Solana cabal eyeing a native stable to “stop giving Circle all the yield” — can a chain coordinate its way to PMF? 🔹 Collective Bargaining Meta — Hyperliquid deal proves apps/chains can extract economics from issuers; could ecosystems unionize to demand rev share? 🔹 Money Velocity Problem — BUSD worked (until it was banned); Huobi’s KUSD died for lack of velocity; most native stables never circulate beyond mints/redemptions. 🔹 Stablecoin-as-a-Service Gold Rush — Everyone launching a wrapped stable: M^0, Paxos, Agora. Does this dilute liquidity and trust — or unlock new UX? 🔹 Trust & Brand Moat — Users can’t be forced to convert; Circle’s scale, bank rails, and liquidity network remain hard to replicate. 🔹 Network Effects ≠ Monopoly — Stablecoin market evolved into USDC/Tether duopoly with niche players (Athena); future may see more vertical-specific winners. 🔹 Reg + Yield Outlook — GENIUS Act may ban interest payments; as rates fall, mint/redeem fees may replace reserve yield as the main revenue source. 🔹 Stablecoin Future — Will Solana, Tempo, Arc, and others fragment liquidity — or finally bring the next billion users on-chain? Hosts⭐️Haseeb Qureshi, Managing Partner at Dragonfly ⭐️Tarun Chitra, Managing Partner at Robot Ventures ⭐️Tom Schmidt, General Partner at Dragonfly Guest ⭐️Gordon Liao, Chief Economist & Head of Research at Circle Disclosures Timestamps 00:00 Intro 00:52 Gordon Liao from Circle 01:48 Stablecoin Chains: Arc vs. Tempo 04:40 Memory Lane with Libra 06:33 Will FX Ever Matter for Stablecoins? 12:06 Challenges with Stablecoin Adoption 23:12 Circle’s Strategy & Competitors 26:13 Stablecoin Negotiations & Ecosystem Dynamics 31:39 Launching a Global Scale Stablecoin 37:25 Role of Trust & Branding 41:25 Stablecoin as a Service 57:53 The Future of Stablecoins Learn more about your ad choices. Visit megaphone.fm/adchoices

18 Sep 1h

Bits + Bips: Could a Base Token Be Coinbase's Key to a Super App? - Ep. 905

This week on Bits + Bips, hosts Steve Ehrlich and Ram Ahluwalia speak with Blockchain.com’s Nic Cary and Franklin Templeton’s Max Gokhman. We talk about how the potential Base token would alter the L2 landscape, and who should capture the value if Coinbase becomes the backbone for DeFi. Also, whether Web2 and TradFi giants will buy their way onchain, why privacy infrastructure is overdue, and how TON’s superapp strategy could pressure social platforms to follow suit. Plus: how Franklin Templeton is valuing L2s and other tokens, why the FOMC’s decision matters for crypto risk, and how tariff talk could spill into digital assets. Thank you to our sponsor, Xapo! Hosts: Steve Ehrlich, Executive Editor at Unchained Ram Ahluwalia, CFA, CEO and Founder of Lumida Guests: Nic Cary, Co-Founder and Vice Chairman at Blockchain.com Max Gokhman, Deputy Chief Investment Officer for Franklin Templeton Investment Solutions Links: Unchained: Base Will Likely Have a Token: Why Now, Who Wins, and How Big It Gets Base Starts to Explore a Native Token Timestamps: 🎬 0:00 Intro 🪙 5:13 The reason for Coinbase’s flip flop on a Base token 🌉 18:33 Should Blockchain.com launch its own L2? 🏗️ 22:05 Is Coinbase becoming the infrastructure layer for DeFi? 📊 25:13 How $1.5 trillion Franklin Templeton builds valuation frameworks for L2s and tokens 📱 30:33 Nic’s case for TON and its superapp strategy 🏦 34:00 Whether Web2 and TradFi giants will buy their way onchain 🕵️ 40:21 Why privacy infrastructure is overdue for crypto but never seems to work 📉 51:03 Surprising predictions regarding the next Fed rate cut 🇺🇸 57:45 Why Trump has a tariff backup plan, and what it means for crypto Learn more about your ad choices. Visit megaphone.fm/adchoices

17 Sep 1h 4min

Base Will Likely Have a Token: Why Now, Who Wins, and How Big It Gets - Ep. 904

Base just crossed its own Rubicon. After months of saying “no token,” Jesse Pollak now says Base must decentralize and is “exploring” a token. What changed? On this episode, Proof of Play’s ICO Beast and former Coinbase Ventures investor Ryan Yi unpack why “exploring” is the operative word, how policy (the Clarity Act) could shape the rollout, and what a points-driven airdrop might look like. We dig into governance realism (what Coinbase will and won’t give up), token utility and valuation math, and how a Base↔Solana bridge could ignite a fight for DeFi liquidity while Solana keeps winning Gen-Z consumers. Mantle is pioneering "Blockchain for Banking" — a revolutionary new category at the intersection of TradFi and web3. Thank you to our sponsor Mantle! Follow Mantle to learn more. Guests: Ico Beast, Merchant of Narratives at Proof of Play Ryan Yi, Ex Coinbase, Coinbase Ventures, and CoinFund Links: Unchained: Base Starts to Explore a Native Token LayerZero Fought the Sybils and Airdropped Its Token. Did the Team Win? Why the War Over the USDH Ticker on Hyperliquid Is Bullish for Crypto Timestamps: 🎬 0:00 Intro 😲 1:32 Why Ryan says this step feels right but is also “shocking” 🧐 3:21 Why Base announced it was exploring a token rather than just launching one 🛠️ 5:19 How Ryan views Base’s decision to stay committed to Ethereum 📊 7:43 What Ryan thinks a fair token allocation would look like ⚖️ 13:43 How the Clarity Act could shape a Base token rollout 🎁 16:23 Will Coinbase distribute through an ICO, an airdrop, or something else? 📈 23:32 Why ICO Beast has a different take on the right allocation 🛡️ 26:10 Why sybil filters will be critical for Base 💡 27:50 What the Base token’s utility could be—and how to value it 🌉 37:24 What the announced Base ↔ Solana bridge could mean ⚔️ 42:08 Whether Ethereum and Solana are heading for a DeFi liquidity war 🔥 45:25 How competition across crypto companies is heating up Learn more about your ad choices. Visit megaphone.fm/adchoices

16 Sep 49min