The Conspiracy Of Democracy

Scholars have explored how democracy, ironically, can create fertile ground for the development of conspiracy theories. One article argues that the competitive nature of democratic politics—with its constant campaigning, media spin, and ideological clashes—can fuel conspiratorial thinking. Another study found that low trust in democratic institutions and feelings of political alienation often correlate with belief in conspiracies, especially among younger or underrepresented groupsBecome a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

28 Juni 3min

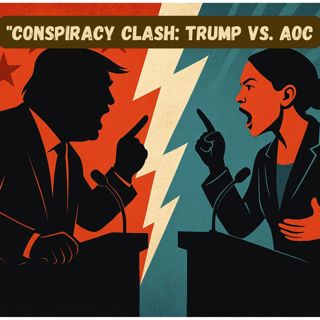

Trump's Social Media Attack on Ocasio-Cortez

Donald Trump launched a lengthy and aggressive social media tirade against Representative Alexandria Ocasio-Cortez after she called for his impeachment over his decision to bomb Iranian nuclear facilities without congressional approval. In his post on Truth Social, Trump insulted Ocasio-Cortez’s intelligence, calling her "one of the dumbest people in Congress," and challenged her to take a cognitive test. He also attacked other progressive lawmakers, including Representatives Jasmine Crockett and Ilhan Omar.Become a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

27 Juni 2min

Democratic Conspiracy

A new generation of left-wing leaders, including Zohran Mamdani, Alexandria Ocasio-Cortez (AOC), and Bernie Sanders, is challenging the Democratic establishment with a grassroots movement aimed at reshaping the party.Become a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

27 Juni 2min

The Salt Conspiracy

The SALT (State and Local Tax) deduction increase primarily benefits taxpayers in high-tax states by allowing them to deduct more of their state and local taxes from their federal taxable income. Here’s the impact: Who Benefits?Higher-income taxpayers in high-tax states (like California, New York, and New Jersey) benefit the most.Middle-income families in high-tax counties may see lower federal tax bills, especially those with large property tax burdens.Itemizers (those who don’t take the standard deduction) will benefit, while standard deduction filers won’t be affected.Become a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

26 Juni 1min

Iran Bombing Conspiracy

There has been a surge of misinformation and conspiracy theories surrounding the recent U.S. strikes on Iran’s nuclear sites. Here’s a summary of the main facts regarding the fake bombing of Iran conspiracy:Misinformation Surge – Social media was flooded with AI-generated and misleading videos claiming to show U.S. strikes on Iran’s nuclear sites. Many were digitally manipulated or repurposed from unrelated footage.Fact-Checking Exposes False Claims – Investigations by DW Fact Check and other outlets revealed that viral clips of explosions, missile strikes, and nuclear tests were either fake or taken out of context.No Downed U.S. Aircraft – False reports claimed that Iran shot down U.S. bombers, but official sources confirmed that all aircraft returned safely.Fake Iranian President Resignation – A fabricated resignation letter of Iran’s President Masoud Pezeshkian circulated online, but he remains in power and has called for retaliation.Disinformation Campaign – The spread of AI-generated war footage highlights growing concerns about deepfake technology and misinformation in global conflicts.Become a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

26 Juni 3min

Big Beautifu Bill Conspiracy

The "Big Beautiful Bill" proposed by former President Donald Trump is a sweeping tax and spending package aimed at extending and expanding the 2017 tax cuts while introducing new tax relief measures. Here are the key highlights:Major Tax Cuts and BenefitsExtension of 2017 Tax Cuts: The bill continues the tax reductions from Trump's first term, amounting to $3.7 trillion in tax savings over the next decade.No Taxes on Tips and Overtime: A major campaign promise, this provision eliminates taxes on tips and overtime wages, though the Senate version introduces a cap of $25,000 for deductions.Senior Tax Relief: Seniors receive an additional $6,000 bonus deduction, though eligibility is capped at $75,000 for single filers and $150,000 for couples.State and Local Tax (SALT) Deduction: The House version increases deductions for high-tax states like California and New York, but the Senate version does not.Made-in-America Tax Breaks: Interest deductions for loans on new American-made vehicles.Child Tax Credit Expansion: Increased and made permanent, benefiting over 40 million families.Economic and Business Incentives100% Expensing for Manufacturing: Businesses can fully deduct expenses for new factories and improvements.Small Business Tax Relief: Permanent enhancements to small business tax deductions.Opportunity Zones Expansion: Unlocks $100 billion for rural and distressed communities.Controversies and ChallengesMedicaid Cuts Rejected: The Senate Parliamentarian blocked provisions that would have capped federal Medicaid funding, which was intended to offset tax cuts.Environmental and Regulatory Rollbacks: Provisions to repeal EPA air pollution rules and limit federal court injunctions were removed.Electric Vehicle (EV) Mandate Reversal: Trump's attempt to undo Biden's EV regulations was likely to be stripped from the bill due to Senate rules.Projected ImpactNational Debt Increase: The bill could add $3.3 trillion to the national debt over the next decade.Taxpayer Benefits: Three in five Americans will continue to have lower federal taxes.Budget Cuts: Proposed spending reductions of $1.3 trillion to offset tax cuts.The bill is currently being debated in the Senate, with revisions expected before a final voBecome a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

26 Juni 1min

Trump Immigration Conspiracy

The Trump administration's immigration policies had significant economic implications, both positive and negative, depending on the perspective: Economic ImpactsLabor Shortages: Stricter immigration enforcement and reduced legal immigration led to labor shortages in industries heavily reliant on immigrant workers, such as agriculture, construction, and hospitality. This slowed economic growth and increased costs for businesses.Reduced GDP Growth: Economists estimated that the administration's restrictive immigration policies could reduce GDP growth by 0.1% to 0.4% annually, resulting in a loss of $30 to $110 billion.Wage Effects: While some argue that reduced immigration could protect wages for native-born workers, studies have shown a minimal impact on wages overall. Immigrants often filled roles that complemented native workers rather than competing directly with them.Innovation and Entrepreneurship: Immigration restrictions potentially stifled innovation and entrepreneurship, as immigrants contribute disproportionately to patents, startups, and technological advancements.Fiscal Contributions: Reduced immigration also meant fewer tax contributions from immigrants, impacting public revenue and funding for programs.Policy HighlightsIncreased ICE raids and deportations created fear in immigrant communities, disrupting families and local economies.Restrictions on asylum applications, refugee admissions, and programs like DACA limited opportunities for many immigrants, further reducing the labor forceBecome a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

25 Juni 3min

The Failure Conspiracy

The Trump administration's airstrikes on Iran's nuclear sites did not destroy Iran's nuclear capacity, despite President Trump's claims that they had been "totally obliterated."Reports from intelligence assessments and nuclear experts indicate that while the strikes damaged Iran's nuclear infrastructure, they did not eliminate its ability to restart enrichment activities. A classified U.S. intelligence report suggests that key components of Iran's nuclear program, including centrifuges, remain largely intact, and Iran had moved enriched uranium to undisclosed locations before the strikes.F urthermore, experts warn that the attacks may have pushed Iran closer to withdrawing from the Nuclear Non-Proliferation Treaty (NPT), potentially accelerating its nuclear ambitions rather than halting them. The International Atomic Energy Agency (IAEA) has stated that a full assessment of the damage is still pending, and no independent verification has confirmed Trump's assertion that Iran's nuclear program was "obliterated"4. This discrepancy between Trump's statements and intelligence assessments has led to skepticism among analysts and policymakers, with concerns that the strikes may have only delayed Iran's nuclear progress rather than stopping it entirelyBecome a supporter of this podcast: https://www.spreaker.com/podcast/conspiracy-theories-exploring-the-unseen--5194379/support.

25 Juni 3min