20Sales: PLG and Early Adopter Sales are Gone, How to do Sales Forecasting in 2023, Why You Cannot Do PLG and Enterprise from Day 1 at the Same Time and Which is Easier to Start, How to Onboard, Manage and Scale Reps with Rich Liu, CRO @ Everlaw

Rich Liu is the CRO @ Everlaw and a unicorn GTM exec having scaled five multi-billion dollar tech unicorns across two IPOs, a successful acquisition, and numerous funding rounds. Prior to Everlaw, Ric...

7 Juni 202351min

20VC: The Largest Venture Backed D2C Consumer Exit; PillPack: $0-$300M Revenues in 5 Years & The Biggest Lessons Scaling the B2B Business to $300M in 2.5 Years with TJ Parker, Co-Founder @ PillPack

TJ Parker is the co-founder and former CEO of PillPack. TJ Raised over $100M in financing, grew the company to more than 1k employees, and successfully sold the business to Amazon for $1B in 2018. As ...

5 Juni 202359min

20VC: Who Wins the AI Race; Startups or Incumbents & Does Having Proprietary Data Really Matter For Startups Today?

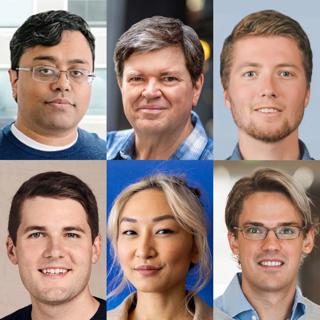

One of the core questions in AI and investing today; who wins, startups or incumbents? Startups have speed and innovation but incumbents have scale, resources, and distribution? Today we hear from 6...

2 Juni 202324min

20VC: The On Running Memo: From Swiss Mountains to NASDAQ IPO: The Story of Three Friends Who Built a Sports Giant

David Alleman is the Co-Founder and Co-Chairman @ On Running one of the fastest-growing global sports brands with over 17 million products sold in 60+ countries. In 2021, On went public on the NASDAQ ...

31 Maj 202344min

20VC: Why Financial Models at Seed, $5M Seed Rounds & The Fear of Signalling Risk is all BS | Why Multi-Stage Firms Have Destroyed Seed & Who Wins and Who Loses in the Next 10 Years of Venture with Adam Besvinick, Founding Partner @ Looking Glass Capital

Adam Besvinick is the Founder of Looking Glass Capital, a pre-seed-focused firm started in 2020. Before starting Looking Glass, Adam spent about 5 years at Deep Fork Capital and Anchorage Capital Grou...

29 Maj 202343min

20Product: How Linkedin Does Product Reviews, A Post-Mortem on Stories, Linkedin Messenger and Spam & Why the Data Advantage in AI is Diminishing with Tomer Cohen, CPO @ Linkedin

Tomer Cohen is the CPO @ Linkedin. Since joining in 2012, Tomer has served in key leadership roles, helping launch and scale new innovative member and customer experiences. He previously led the growt...

26 Maj 202345min

20VC: Why Being First To Market Does Not Matter, Why You Do Not Have Defensibility on Day 1, How to Analyse Market Size and Present it to Investors, Vitamins vs Painkillers; Do Vitamins Survive Recessions and Good vs Great Messaging with Guy Podjarny @ Sn

Guy Podjarny is the Founder of Snyk, the leading Developer Security platform, helping developers secure as they build. Guy was previously CTO at Akamai, co-founded Blaze.io (acquired by Akamai), and w...

24 Maj 202358min

20VC: Why Your Fund Model Should Not Rely on $10BN+ Outcomes, Why the Large Funds Got Too Large, The Rise of Solo GP's; The Pros and Cons & Is Consumer Subscription Even a Good Sector to Invest in with Nico Wittenborn @ Adjacent

Nico Wittenborn is the Founder of Adjacent, one of the best early-stage firms created over the last 5 years. Before starting Adjacent, Nico spent over 3 years at Insight Partners in New York and befor...

22 Maj 20231h 6min